What is Stable Diffusion Stock and How to Invest it?

In the rapidly evolving world of artificial intelligence (AI), one company that has been making waves is Stability AI, the creator of the open-source generative AI model, Stable Diffusion. This article will delve into what Stable Diffusion is, its stock, and how to invest in it. We will also provide our insights and recommendations on the matter.

Table of Contents

What is Stable Diffusion Stock?

Stable Diffusion is a product of Stability AI, a company that focuses on building general and artificial intelligent products that benefit humans and businesses on a global scale. The company’s stock represents a share in the ownership of Stability AI and constitutes a claim on part of the company’s assets and earnings. The stock is a way for investors to participate in the company’s growth and success.

What is Stable Diffusion?

Stable Diffusion is a pioneering text-to-image model launched by Stability AI. It has been wildly successful, with four of the top 10 applications on Apple’s App Store powered by Stable Diffusion just one month after the release of SD 2.0. The model is open-source, meaning it’s freely available for developers to use and modify. This open-source model has the potential to revolutionize various industries, from entertainment to education, by providing a powerful tool for generating realistic images from text descriptions.

Is Stable Diffusion Worthy Investing?

Investing in Stable Diffusion stock means investing in the future of AI. However, it’s important to note that Stability AI has been reported to be burning through cash at an alarming rate without a clear path to profitability. The company is facing stiff competition, and its future fundraising round is on shaky grounds. Therefore, potential investors should carefully consider these factors.

While the company’s financial situation is concerning, it’s also worth noting that Stability AI is at the forefront of a rapidly growing industry. The success of Stable Diffusion demonstrates the company’s ability to create innovative and popular products. If Stability AI can overcome its current challenges, it could be well-positioned to benefit from the continued growth of the AI industry.

What is Stable Diffusion Stock Price?

As of the time of writing, the exact stock price for Stable Diffusion is not publicly available. Investors are advised to check the latest updates from reliable financial news sources or the company’s official website. It’s important to remember that stock prices can fluctuate based on a variety of factors, including the company’s financial performance, market conditions, and investor sentiment.

What is Stable Diffusion Stock Symbol?

The stock symbol for Stable Diffusion is also not publicly available at this time. Investors should keep an eye on financial news for any updates. The stock symbol is a unique series of letters assigned to a security for trading purposes.

What is Stable Diffusion Stock Name?

The stock is typically referred to as Stability AI stock, named after the company that developed Stable Diffusion. This name is used in financial news and reports, and on trading platforms.

Who Owns Stable Diffusion Stock?

Stable Diffusion stock is owned by investors who have purchased shares in Stability AI. The specific identities of these investors are not publicly disclosed, but they can include individuals, institutional investors, and other companies.

How to Invest Stable Diffusion Stock?

Investing in Stable Diffusion stock involves purchasing shares of Stability AI. This can be done through a brokerage account. However, as the company is in a precarious financial situation, potential investors are advised to conduct thorough research and consider seeking advice from financial advisors.

Alternatives to Invest Stable Diffusion Stock

Here are five AI-related stocks that are worth considering:

Name | Stock Symbol | Market Cap | Price | Past 6 Months |

|---|---|---|---|---|

Microsoft | MSFT | $2.51T | $337.99 | 108.89 (47.53%) |

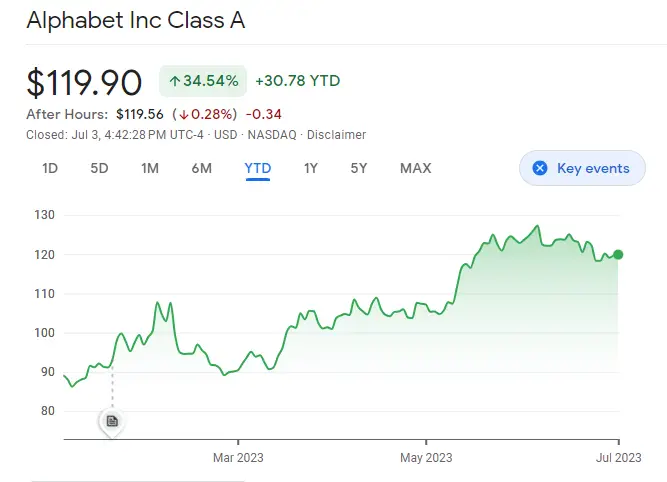

Alphabet | GOOGL | $1.53T | $119.90 | 31.82 (36.13%) |

Nvidia | NVDA | $1.05T | $424.13 | 276.64 (187.57%) |

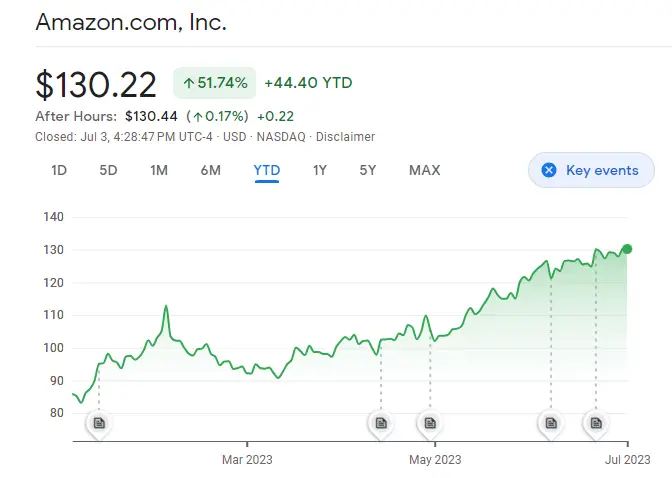

Amazon | AMZN | $1.34T | $130.22 | 45.08 (52.95%) |

C3.ai Inc | AI | $4.33B | $37.48 | 26.14 (230.51%) |

1. Microsoft ( MSFT )

Microsoft has established a strong alliance with OpenAI and ChatGPT, making it one of the key companies closely associated with them. With a significant investment of over $10 billion in OpenAI since 2019, Microsoft has forged a deep partnership with ChatGPT. One of Microsoft’s notable aspirations is to seamlessly integrate ChatGPT into Bing, thereby presenting a formidable challenge to Google’s supremacy in the search engine industry. As of 2023, Microsoft experienced a remarkable surge in its stock price, witnessing an impressive increase of 47.53%.

2. Alphabet (GOOGL)

Alphabet, the parent company of Google, plays a crucial role in the field of artificial intelligence and has a profound impact on ChatGPT. Despite their substantial investments in AI research, which may exert short-term financial pressure, analysts remain optimistic about Alphabet and rate it as a “buy,” with a predicted 31% increase in value. Google’s exceptional performance in web traffic, data, and AI capabilities, along with its ongoing partnerships, contribute to Alphabet’s strong growth potential. While the popularity of ChatGPT may have a limited impact on Alphabet’s stock price, according to analysis from the Bank of America, the company is expected to perform well. Investors have confidence in Alphabet’s future, recognizing its leadership position and innovative capabilities in the field of artificial intelligence.

3.NVIDIA(NVDA)

Investing in companies that provide crucial infrastructure, such as computational power, for ChatGPT is a wise choice, and NVIDIA, the global leader in GPU chip manufacturing, stands out as an exemplary player in this field. Their A100 series chips are renowned for their exceptional computing power and are essential for training large language models like ChatGPT. Since the launch of ChatGPT, there has been an unprecedented surge in demand for NVIDIA GPUs, resulting in a significant 187.57% increase in their stock price in 2023. With a market value approaching a trillion dollars, NVIDIA has rapidly risen to become the sixth-largest company globally. It is evident that in the era of artificial intelligence, NVIDIA is destined to be one of the most powerful hardware companies. Investing in NVIDIA stocks represents tremendous value potential.

4.Amazon (AMZN)

Amazon (AMZN) stock has experienced significant growth and a notable increase, demonstrating a positive trend. In the current year, the stock has surged by 52.95%. As a multinational conglomerate, Amazon plays a pivotal role in the field of artificial intelligence (AI) by integrating AI technology across its diverse range of businesses. Through its Amazon Web Services (AWS) platform, the company offers cloud-based AI services and leverages AI algorithms to enhance customer experiences and optimize operations. Amazon’s strategic emphasis on AI empowers it to drive innovation and maintain a competitive advantage. With its strong commitment to AI, Amazon is well-positioned for long-term growth, making it an appealing choice for investors.

5.C3.ai Inc(AI)

C3.ai Inc (AI) is a promising investment option with a market value of $4.33 billion and a current stock price of $37.48. Over the past six months, the stock has exhibited significant growth, soaring by an impressive 230.51%. C3.ai specializes in providing enterprise AI software solutions, leveraging advanced technologies like machine learning and big data analytics. Their innovative offerings and strong market performance position C3.ai as a leader in the AI software market. With the increasing demand for AI-driven technologies, C3.ai presents a compelling investment opportunity, driven by its track record of growth and potential for further expansion in the evolving AI landscape.

These companies represent some of the leading players in the AI industry. They have demonstrated strong performance and have a solid track record of innovation in AI.

What Does the Future Hold for Stable Diffusion Stock?

The future of Stable Diffusion stock is uncertain. With the company facing financial difficulties and stiff competition, it’s unclear whether it will be able to maintain its current position in the AI market. However, the success of Stable Diffusion and the company’s commitment to open-source development suggest potential for growth if it can overcome its current challenges.

In my opinion, the future of Stable Diffusion stock will largely depend on the company’s ability to achieve profitability and continue innovating in the rapidly evolving AI industry. If Stability AI can successfully navigate these challenges, Stable Diffusion stock could offer significant potential for long-term growth.

Conclusion:

Investing in Stable Diffusion stock represents a bet on the future of AI. While the company faces significant challenges, its innovative products and commitment to open-source development could make it a worthwhile investment for those willing to take on risk. However, potential investors should conduct thorough research and consider seeking advice from financial advisors before making any investment decisions. It’s also important to consider other investment options in the AI industry, such as the alternative stocks mentioned above.