How to Invest AI Stock ?10 Best AI Stocks in 2023

When it comes to investing in AI stocks, having a comprehensive understanding of all relevant information is crucial. Many companies offer impressive AI technologies, but finding a company that performs well in the stock market and has a strong connection to AI can be challenging. Here, we will highlight the top 10 AI stocks, their performance in 2023, and their level of association with AI. Keep reading to find the best investment choices for you!

Table of Contents

Editor’s pick

Name | Stock Symbol | Market Value | Stock Price | 2023 Growth Rate |

|---|---|---|---|---|

Microsoft | MSFT | $2.51T | $337.56 | +38.8% |

NVIDIA | NVDA | $1.08T | $438.08 | +165.49% |

Alphabet | GOOGL | $1.57T | $123.10 | +37.42% |

Baidu | BIDU | $50.17B | $143.52 | +26.68% |

Adobe | ADBE | $274.73B | $485.86 | +42.32% |

AMD | AMD | $191.52B | $118.93 | +75.72% |

Upstart | UPST | $2.76B | $33.39 | +137.99% |

SoundHound AI | SOUN | $867.40M | $3.99 | +291.18% |

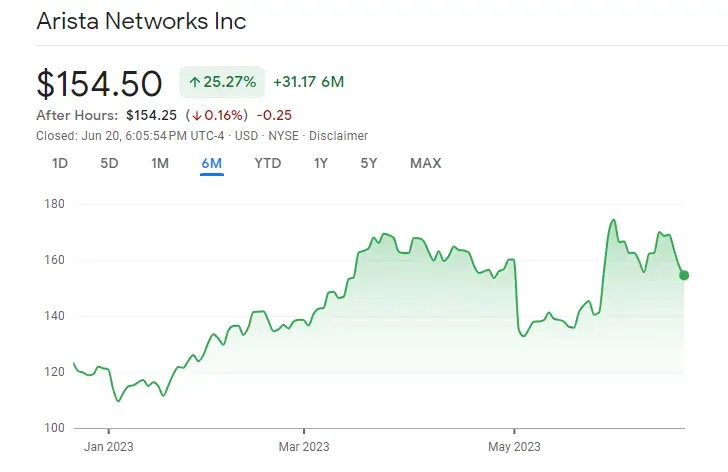

Arista Networks | ANET | $47.63B | $154.5 | +25.27% |

Qualcomm | QCOM | $133.48B | $119.82 | +4.56% |

10 Best AI Stocks in 2023

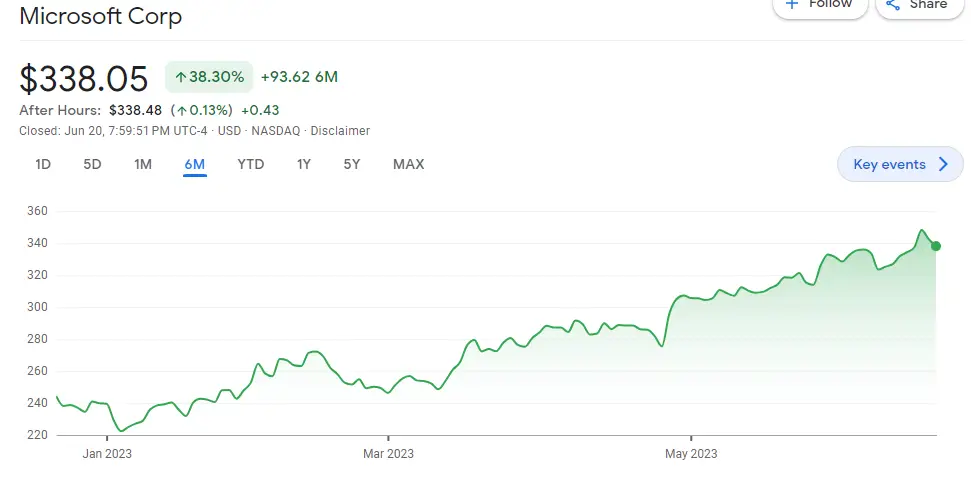

1. Microsoft ( MSFT )

Microsoft, a technology giant, has been actively involved in the field of artificial intelligence. In addition to investing over $10 billion in OpenAI and establishing a deep collaboration with ChatGPT, Microsoft offers a range of AI services and tools through its Azure cloud platform. The company aims to integrate AI into various products and services, including the Bing search engine, to provide more intelligent and personalized experiences. Microsoft’s stock has shown strong performance in recent months, with a 38.8% increase, reflecting investors’ optimism about its AI strategy.

Positive Factors:

- Microsoft’s cloud services, including Azure, continue to experience strong growth, providing a stable source of revenue for the company.

- Investments and research and development in the field of artificial intelligence (AI) by Microsoft are yielding results, which may drive the company’s future growth.

- The user base of Microsoft’s subscription services such as Office 365 and Microsoft 365 is steadily growing, contributing to stable revenue for the company.

Negative Factors:

- Microsoft may face intense competition from rivals such as Google and Amazon, which could impact the company’s market share and revenue.

- Some of Microsoft’s products and services may face data security and privacy issues, which could affect the company’s reputation and business.

- The global chip shortage may impact the production and sales of Microsoft’s hardware products such as Surface and Xbox.

Analyst Ratings: Overweight

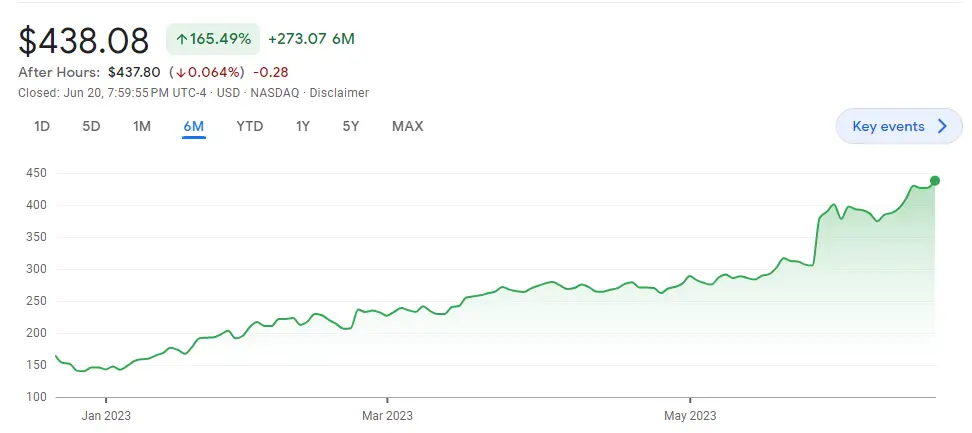

2.NVIDIA(NVDA)

As a global leader in GPU manufacturing, NVIDIA plays a crucial role in the field of artificial intelligence. Its high-performance GPU chips excel in training large-scale language models and conducting deep learning tasks. In recent months, NVIDIA’s stock has demonstrated a strong upward trend, with a remarkable 172% increase. The company benefits not only from the rapid growth of AI but also from the demand in areas such as cryptocurrency mining.

Positive Factors:

- NVIDIA’s leadership position in artificial intelligence (AI) and deep learning gives it significant growth potential in the coming years.

- Strong demand for NVIDIA’s graphics processing units (GPUs) in the gaming and data center markets is expected to drive revenue growth.

- NVIDIA’s autonomous driving platform, Drive, is gaining wide acceptance among automakers and could become a new source of revenue for the company.

Negative Factors:

- NVIDIA may face intense competition from rivals such as AMD and Intel, which could impact the company’s market share and revenue.

- Global chip shortages may affect NVIDIA’s product supply, impacting sales and profits.

- Some of NVIDIA’s products may face technical and security issues, which could affect the company’s reputation and business.

Analyst Ratings: Overweight

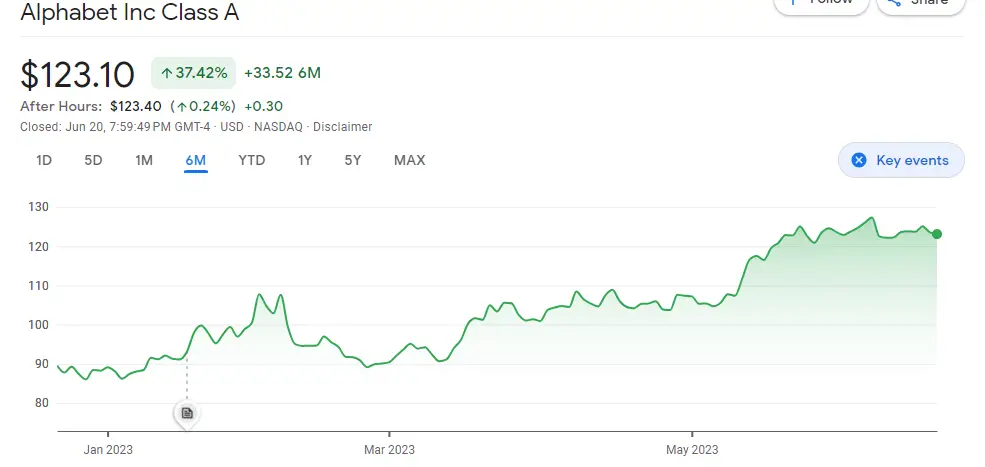

3. Alphabet (GOOGL)

As one of the largest internet companies globally, Google, a subsidiary of Alphabet, has been extensively involved in AI research and application. Google has introduced advanced AI solutions in areas such as search engines, autonomous driving, and speech recognition. Alphabet, as Google’s parent company, continues to invest in AI research and innovation. While further analysis is required for the recent stock trend, Alphabet possesses significant potential for long-term growth due to its strong presence and capabilities in the AI field.

Positive Factors:

- Alphabet’s search engine, Google, dominates the global market, providing the company with stable advertising revenue.

- Investments and research and development in areas such as cloud computing, artificial intelligence (AI), and autonomous driving by Alphabet are yielding results, which may drive the company’s future growth.

- The user base of Alphabet’s services such as YouTube and Google Play continues to grow, contributing to stable revenue for the company.

Negative Factors:

- Alphabet may face intense competition from rivals such as Microsoft and Amazon, which could impact the company’s market share and revenue.

- Some of Alphabet’s products and services may face data security and privacy issues, which could affect the company’s reputation and business.

- Changes in global regulatory environments, such as GDPR in Europe and data protection regulations in other regions, may impact Alphabet’s business and profitability.

Analyst Ratings: Overweight

4.Baidu (BIDU)

Analyst Ratings: Overweight

Baidu is one of China’s largest search engines and leading AI companies. The company has made significant investments in research and application of AI, including natural language processing, image recognition, and intelligent driving. Recently, Baidu launched chatbot services like Ernie Bot to meet the growing demand for intelligent conversation systems. Baidu’s stock has risen by 26.68% in the past six months, reflecting the market’s positive outlook on the company’s AI technology and business prospects.

Positive Factors:

- Baidu’s investments and research and development in areas such as artificial intelligence (AI) and autonomous driving are yielding results, which may drive the company’s future growth.

- Baidu’s search engine dominates the Chinese market, providing the company with stable advertising revenue.

- The user base of Baidu’s cloud services and other online services continues to grow, contributing to stable revenue for the company.

Negative Factors:

- Baidu may face intense competition from rivals such as Google and Alibaba, which could impact the company’s market share and revenue.

- Some of Baidu’s products and services may face data security and privacy issues, which could affect the company’s reputation and business.

- China’s regulatory environment may impact Baidu’s business and profitability.

Analyst Ratings: Overweight

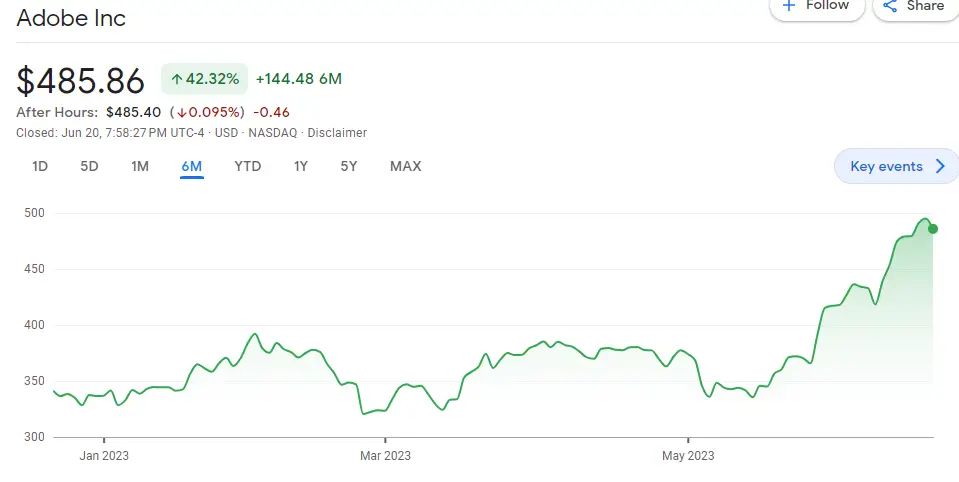

5.Adobe (ADBE)

Adobe, renowned for its creative and design software, has increasingly ventured into the field of artificial intelligence. The company has introduced AI-driven tools and services like Adobe Sensei to enhance the creative process and improve user experiences. In recent months, Adobe’s stock has demonstrated strong performance, with a 42.32% increase. The company has made positive strides in applying and integrating AI technology, laying a foundation for its future growth.

Positive Factors:

- Adobe’s innovative products and services such as Photoshop, Illustrator, and Premiere Pro generate stable revenue for the company.

- Investments and research and development in cloud services and artificial intelligence (AI) by Adobe are yielding results, which may drive the company’s future growth.

- The user base of Adobe’s subscription services continues to grow, contributing to stable revenue for the company.

Negative Factors:

- Adobe may face intense competition from rivals such as Microsoft and Google, which could impact the company’s market share and revenue.

- Some of Adobe’s products and services may face data security and privacy issues, which could affect the company’s reputation and business.

- Changes in global regulatory environments, such as GDPR in Europe and data protection regulations in other regions, may impact Adobe’s business and profitability.

Analyst Ratings: Overweight

6.AMD(AMD)

AMD (AMD): Advanced Micro Devices, or AMD, is a significant player in the semiconductor industry, with its processors and graphics cards being integral to AI computations. AMD’s products are used in servers, workstations, personal computers, and gaming consoles. Over the past few months, AMD’s stock has shown a steady upward trend, reflecting the company’s strong performance and the growing demand for its products.

Positive Factors:

- AMD’s innovative products and services, such as its processors and graphics cards, generate stable revenue for the company.

- Investments and research and development in cloud services and artificial intelligence (AI) by AMD are yielding results, which may drive the company’s future growth.

- AMD’s processors are experiencing growing demand in the gaming and data center markets, contributing to stable revenue for the company.

Negative Factors:

- AMD may face intense competition from rivals such as Intel and Nvidia, which could impact the company’s market share and revenue.

- Some of AMD’s products and services may face data security and privacy issues, which could affect the company’s reputation and business.

- The global chip shortage may impact the supply of AMD’s products, thereby affecting the company’s revenue and profitability.

Analyst Ratings:Overweight

7.Upstart ( UPST )

Upstart (UPST): Upstart, an AI-driven lending platform, has effectively weathered the pandemic-led headwinds and emerged even stronger. Its prudent cost management and AI-powered credit scoring model have outperformed traditional methods, making it an attractive proposition for investors. The stock has seen a significant increase over the past three months, reflecting the company’s robust financial performance and the growing acceptance of AI-driven lending platforms.

Positive Factors:

- Upstart’s AI-driven lending platform has effectively weathered the headwinds caused by the pandemic and emerged stronger.

- Upstart’s prudent cost management and AI-powered credit scoring model have effectively outperformed traditional methods, creating an enticing proposition for investors.

Negative Factors:

- Upstart may face intense competition from competitors, which could impact the company’s market share and revenue.

- Some of Upstart’s services may face data security and privacy issues, which could affect the company’s reputation and business.

- Changes in the global economic environment, such as fluctuations in interest rates and the impact of the pandemic, may affect Upstart’s business and profitability.

Analyst Ratings:Hold

8.SoundHound AI ( SOUN )

SoundHound AI (SOUN): SoundHound AI has carved out a unique space in conversational AI, aiming to create tech-human interactions that feel as natural as conversations with friends. This focus on conversational AI has made it one of the most attractive AI penny stocks. Over the past few months, SoundHound’s stock has shown a significant upward trend, reflecting the growing interest in conversational AI technologies.

Positive Factors:

- SoundHound AI has carved out a unique space in the conversational AI field, aiming to create tech-human interactions that feel as natural as conversations with friends.

- SoundHound AI has a leading edge in AI technology when it comes to music search and voice recognition.

Negative Factors:

- SoundHound AI may face intense competition from rivals, which could impact the company’s market share and revenue.

- Some of SoundHound AI’s services may face data security and privacy issues, which could affect the company’s reputation and business.

- The development and application of AI technology may be subject to regulatory limitations and ethical concerns, which could impact SoundHound AI’s business and profitability.

Analyst Ratings:Buy

9.Arista Networks ( ANET )

Arista Networks (ANET): Arista Networks is a significant player in the networking industry, specializing in providing cloud networking solutions. These solutions are specifically designed to meet the demands of AI-driven workloads, making Arista Networks a key contributor to the AI industry. The company’s high-throughput data center switches are crucial for handling the massive data processing requirements of AI applications. Despite recent fluctuations in the stock market, with a 9.40% increase in the past month and a -6.96% decrease in the past three months, the company’s annual performance demonstrates a promising growth of 66.06%.

Positive Factors:

- Arista Networks stands out in the networking sector, specializing in cloud networking solutions tailored to meet the demands of AI-driven workloads.

- Arista Networks’ products and services have widespread applications in data centers and cloud computing, providing a stable source of revenue for the company.

Negative Factors:

- Arista Networks may face intense competition from rivals such as Cisco and Juniper Networks, which could impact the company’s market share and revenue.

- Some of Arista Networks’ products and services may face data security and privacy issues, which could affect the company’s reputation and business.

- The global chip shortage may impact the production and sales of Arista Networks’ hardware products.

Analyst Ratings:Overweight

10.Qualcomm(QCOM)

Qualcomm (QCOM) is a leading developer and provider of digital telecommunications products and services, covering various areas such as integrated circuits, system software, and intellectual property licensing. In the field of AI, Qualcomm focuses on developing AI-enabled chips for mobile applications, connected cars, and IoT applications, and sees a trillion-dollar market opportunity. Despite recent fluctuations in stock performance and the impact of weak demand for smartphones, Qualcomm continues to invest in AI technology and is expected to drive its future growth.

Positive Factors:

Qualcomm is a leading provider of mobile communication technology, with its chips widely used in smartphones and mobile devices, providing a stable source of revenue for the company.

Qualcomm holds a leading position in the field of 5G technology, and with the global rollout of 5G networks, the company is poised to benefit from it.

Qualcomm has strong research and development capabilities and a robust patent portfolio in wireless technology and semiconductors, supporting the company’s innovation and competitiveness.

Negative Factors:

Qualcomm may face intense competition from rivals such as Intel and NVIDIA, which could impact the company’s market share and revenue.

The global chip shortage may affect the supply and production of Qualcomm’s hardware products.

Changes in policies and regulations may have adverse effects on Qualcomm’s business.

Analyst Ratings:Overweight

Why invest in AI stocks? What are the prospects?

Investing in AI stocks offers several advantages.

- Growth Potential: The AI industry is expected to bring more than $10 trillion in revenue by 2030. The AI chatbot market, in particular, is expected to grow significantly, especially in enhancing customer engagement.

- Innovative Technology: AI companies are at the forefront of technological innovation. They are developing advanced AI models that can be used for natural language processing, generating human-like text responses, and more.

- Diversification: AI stocks offer a way to diversify your investment portfolio. They are not directly influenced by traditional economic factors, making them a good hedge against economic downturns.

- Resilience: During the COVID-19 pandemic, AI companies have demonstrated the robustness of their solutions, adapting to the demand for remote communication and other changes in the business environment.

- The future prospects for AI stocks indeed appear to be very positive, driven by several key factors.

- Growing Demand: As businesses seek to enhance customer engagement, reduce costs, and improve efficiency, the demand for AI technologies is expected to continue growing in the coming years.

- Technological Advancements: AI companies are continuously innovating and developing more advanced AI models. For example, ChatGPT has already been upgraded to the more advanced GPT-4, demonstrating ongoing technological progress.

- Expansion Opportunities: AI companies have already established a strong presence in the market, but there is still potential for expansion. They may explore new markets, develop new products, and seek additional partnerships.

Also read:What is Chat GPT Stock Price and How to Buy Chat GPT Stock?

What need to pay attention to when investing in AI stocks?

While investing in AI stocks can be lucrative, it’s important to understand the potential risks.

- Early Stage: The AI industry is still in its early stages, and many companies are not yet profitable. This means that they may be more vulnerable to financial difficulties and market fluctuations.

- Competition: The AI field is highly competitive, with many companies vying for market share. This competition can make it difficult for smaller or newer companies to succeed.

- Regulation: As AI technologies become more prevalent, they are likely to face increased regulation. This could impact the profitability and growth prospects of AI companies.

- Technological Risk: AI technologies are complex and rapidly evolving. There is a risk that a company’s technology could become obsolete, or that it could be surpassed by more advanced technologies developed by competitors.

Therefore, it’s crucial to do thorough research and consider the company’s financial health, competitive position, and growth prospects before investing. It may also be beneficial to consult with a financial advisor or investment professional.

See more:Generative AI Meaning:What is it and Why is it so popular?

Conclusion

The AI revolution is rapidly unfolding, capturing the attention of investors. The transformative touch of AI is just the beginning, making AI stocks an exciting prospect for investors. However, like any investment, understanding the potential risks is key. Only when you have a thorough understanding of how these AI companies operate and their position in the market can you make an informed investment decision. As we continue to ride the crest of this technological revolution, the potential for growth and innovation in the AI industry is truly exciting.

See more:AI Chip Ban: A Storm Brewing for AMD and Nvidia Stocks?