What is Chat GPT Stock Price and How to Buy Chat GPT Stock?

The AI revolution, represented by ChatGPT and other AI technologies, is rapidly unfolding, capturing the attention of investors. In 2023, stocks of AI-related tech companies are soaring, and this article will provide a detailed introduction to ChatGPT stock and other hot AI stocks, helping you stay ahead in AI investments.

At the moment, ChatGPT stock hasn’t been made available for public trading. This means that you won’t find its price or stock symbol on the stock market, and purchasing it directly is not an option. If you’re interested in investing in ChatGPT stock, your best avenue is to keep a watchful eye on the OpenAI IPO.

Stay informed about the latest developments by following OpenAI on Twitter (@OpenAI)and staying tuned to Nasdaq announcements.

Table of Contents

What is Chat GPT Stock?

Chat GPT stock is not a publicly traded. OpenAI, the company that developed ChatGPT, is a private company. As of May 2023, neither ChatGPT nor OpenAI are listed on any securities exchange. Therefore, there are no specific stocks related to ChatGPT or OpenAI that can be traded on the stock market.

You can also read:Inflection AI stock

What is Chat GPT and Open AI?

ChatGPT is a large language model chatbot developed by OpenAI. It is an advanced artificial intelligence model that can be used for natural language processing and generating human-like text responses. OpenAI is a research laboratory founded by Elon Musk, Sam Altman, and others. It is a non-profit organization. In January 2023, Microsoft announced a $10 billion investment in OpenAI.

See more:Chat GPT Login

What is Chat GPT stock price?

ChatGPT is not a publicly traded company, so there is no ChatGPT stock price. The only way to invest in ChatGPT is to invest in OpenAI, the company that developed it. You can do this by buying shares of Microsoft (MSFT), which has a strategic partnership with OpenAI. Microsoft’s stock price is currently $389.46.

What is Chat GPT stock symbol?

ChatGPT is not a publicly traded company, so it does not have a stock symbol. The only way to invest in ChatGPT is to invest in OpenAI, the company that developed it. You can do this by buying shares of Microsoft (MSFT), which has a strategic partnership with OpenAI. Microsoft’s stock symbol is MSFT.

What is Chat GPT stock name?

ChatGPT does not have a specific stock name as it is not publicly traded. However, users can indirectly engage with ChatGPT by investing in Microsoft stock (NASDAQ stock symbol: MSFT). Investing in Microsoft is the most direct way to participate in the potential impact of ChatGPT and its related technologies.

ChatGPT Stock Ticker

As of the publication date, chatgpt stock has not been publicly issued, so real-time stock information for chatgpt is not available. However, according to a previous report by Forbes, OpenAI was valued at $29 billion after Microsoft completed a $10 billion investment in January 2023.

ChatGPT Stock Chart

Since chatgpt stock has not been publicly traded on the stock market, there is no stock chart available for chatgpt stock. Analyzing the user growth trends on platforms like SimilarWeb might provide insights that could be helpful for predicting chatgpt stock performance.

ChatGPT Stock Predictions

The best way to make predictions about chatgpt stock would be to rely on publicly available financial reports. However, since chatgpt stock has not been listed publicly, accurate financial data is not available at this time. Predictions for chatgpt stock would typically consider factors such as revenue, profit, market size, user base, and more. I recommend referring to data analytics chatgpt for more information.

ChatGPT Stock Trading

Chatgpt stock has not been publicly issued, and therefore, it cannot be traded on the public stock market. The only way to engage in chatgpt stock trading would be to participate in its next funding round or purchase shares from existing chatgpt stockholders.

Who owns Chat GPT stock?

As I mentioned before, ChatGPT is not a publicly traded company, so there is no ChatGPT stock. The only way to invest in ChatGPT is to invest in OpenAI, the company that developed it. owns ChatGPT stock.

How to buy Chat GPT stock?

ChatGPT is not a publicly traded company, so there is no ChatGPT stock. You cannot buy ChatGPT stock. However, you can invest in Open AI or invest in other ChatGPT stock alternatives.

Learn more:How to Invest AI Stock ?10 Best AI Stocks in 2023.

Invest in Open AI

Open AI ,the company that developed ChatGPT. OpenAI is a private company, so you cannot buy shares directly,you can invest in OpenAI through a venture capital firm or an exchange-traded fund (ETF).

Here are some of the venture capital firms that have invested in OpenAI:

- Andreessen Horowitz

- Founders Fund

- Peter Thiel’s Founders Fund

- Sam Altman’s Y Combinator

Here are some of the ETFs that track the performance of venture capital firms:

- First Trust Nasdaq Emerging Growth ETF

- Vanguard Growth ETF (VUG)

- iShares Core Growth ETF (IWF)

Please note that investing in OpenAI or any other venture capital firm is a high-risk investment. There is no guarantee that you will make money, and you could lose all of your investment.

Alternatives to Invest ChatGPT stock

Alternatives to chat gpt stock refer to companies or competing products related to ChatGPT. AI is regarded as the most important computing platform in the next ten years. According to predictions, the AI industry will bring more than 10 trillion US dollars in revenue by 2030, so investment ChatGPT-related stocks are also a good strategy. Top 5 chat gpt stock alternatives:

Name | Stock Symbol | Market Cap | Price | Past 6 Months |

|---|---|---|---|---|

Microsoft | MSFT | $2.45T | $330.11 | 63.38 (+23.76%) |

NVIDIA | NVDA | $1.12T | $454.16 | 232.12 (+104.53%) |

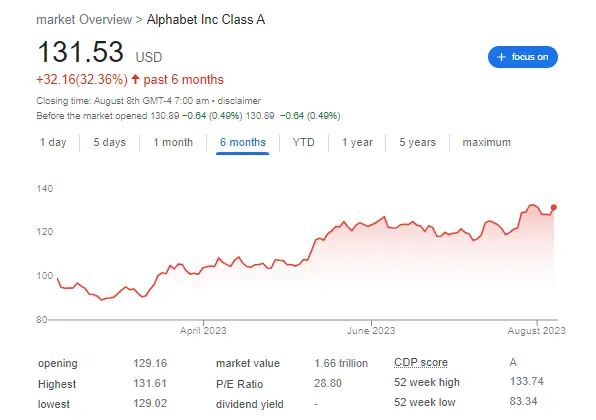

Alphabet | GOOGL | $1.66T | $131.53 | 32.16 (+32.36%) |

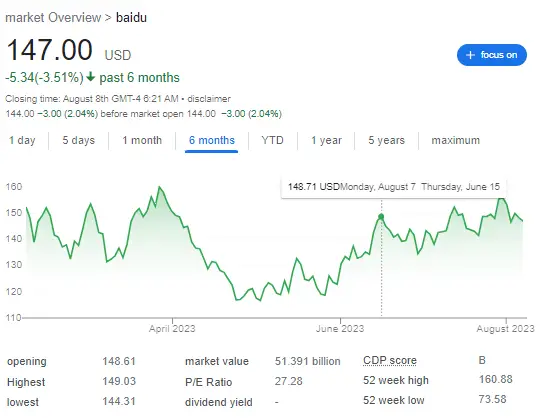

Baidu | BIDU | $51.391B | $147 | -5.34 (-3.51%) |

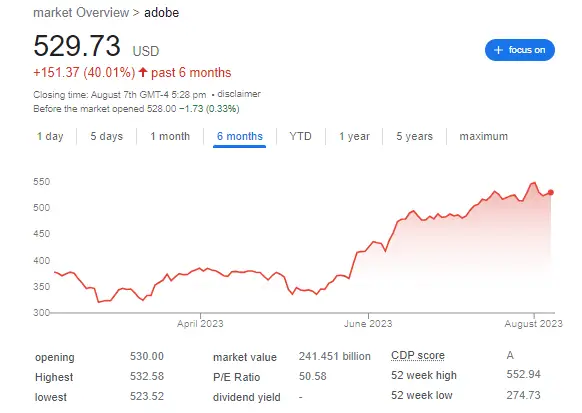

Adobe | ADBE | $241.451B | $529.73 | 151.37(+40.01%) |

1. Microsoft ( MSFT )

The most direct is to invest in Microsoft. Microsoft has invested more than 10 billion U.S. dollars in Open AI since 2019, and it is also the company that has the deepest cooperation with ChatGPT. Microsoft’s biggest ambition is to integrate ChatGPT into bing to challenge the status of Google’s search engine. If you’re looking for the company most connected to OpenAI and ChatGPT, Microsoft is your best bet. Microsoft Shares Up 38.8% in 2023.

2.NVIDIA(NVDA)

The most important infrastructure of ChatGPT is computing power, which is the key to AI model training, so investing in computing power companies is also a very good choice. NVIDIA is the strongest GPU chip manufacturing company in the world. Its A100 series chips are currently the most powerful GPUs and are the key computing power necessary for training ChatGPT large-scale language models. Since the release of ChatGPT, NVIDIA’s GPUs have been in short supply. NVIDIA’s stock price has risen by 172% in 2023, and its market value is approaching one trillion U.S. dollars, ranking soaring to No. 6 in the world! It can be predicted that NVIDIA will become the most powerful hardware company in the AI era.

3. Alphabet (GOOGL)

Alphabet’s dominance in the AI field has an impact on ChatGPT.Alphabet has already invested an estimated $27 billion to $137 billion in AI research, which could have short-term financial implications. Despite potential risks, analysts still rate Alphabet as a “buy,” projecting a 31% higher value compared to the current status.Given Google’s dominant position in internet traffic, along with its excellent data and AI capabilities, there is greater potential for a rise in the stock price of its parent company, Alphabet. Particularly, Samsung’s continued choice of Google as the default search engine for its smartphones will benefit Alphabet in maintaining its leadership in the search sector. Therefore, even with the growing traffic to ChatGPT, Bank of America believes it doesn’t constitute a substantial impact on Alphabet’s stock price.

4.Baidu (BIDU)

Baidu, one of China’s largest search engines and AI companies, has responded to ChatGPT with the launch of its chatbot service, Ernie Bot. Meanwhile, OpenAI continues to improve and introduce more powerful versions of ChatGPT, such as ChatGPT-4.Baidu has emerged as one of the top-performing stocks in both the Nasdaq Golden Dragon China Index and the Hang Seng Technology Index this year, making it a popular choice among investors. The company has maintained an optimistic outlook on its AI technology and has shown strong profitability throughout the year, with promising prospects ahead..Shares are up 26.68% this year

5.Adobe (ADBE)

Adobe has launched its generative AI tool called Adobe Firefly, entering the AI competition. Firefly is a series of creative generative AI models that will be integrated into Adobe’s product lineup, including applications and services. With the release of the first beta version of Firefly, creators will be able to generate new content in digital imaging, photography, illustration, artwork, graphic design, and video using everyday language. While concerns arise about the impact of such tools on the role of creators, Adobe emphasizes a “creator-first” approach, committing to prioritize and responsibly develop creative generative AI with creators in mind.With Adobe stock up 42.32% in 2023, it’s worth investing in.

Should you invest in ChatGPT?

Investing in ChatGPT stock depends on your risk tolerance, but there are several advantages to consider:

- Growth Potential: The AI chatbot market is expected to grow significantly, especially in enhancing customer engagement.

- Innovative Technology: ChatGPT utilizes the advanced GPT-4 technology, bringing significant advantages to high-quality chat solutions.

- Diversification: ChatGPT stocks offer diversified AI investment portfolios, uninfluenced directly by traditional economic factors.

- Resilience: During the COVID-19 pandemic, ChatGPT has demonstrated the robustness of its solutions, adapting to the demand for remote communication.

What Does the Future Hold for ChatGPT Stock?

The future prospects for ChatGPT indeed appear to be very positive, driven by several key factors:

- Growing Demand: As businesses seek to enhance customer engagement and reduce costs, the demand for AI chatbots is expected to continue growing in the coming years.

- Technological Advancements: Building upon the foundation of GPT-3, ChatGPT has already been upgraded to the more advanced GPT-4, demonstrating ongoing technological progress.

- Expansion Opportunities: ChatGPT has already established a strong presence in the market, but there is still potential for expansion. The company may explore new markets, develop new products, and seek additional partnerships.

- Financing and Valuation Growth: Reports suggest that OpenAI is currently in negotiations for a private tender sale of shares with venture capital firms Thrive Capital and Founder Fund. This could result in approximately $300 million in funding and increase the company’s valuation to $29 billion. Furthermore, it is projected that revenues for 2023 and 2024 will reach $200 million and $1 billion, respectively. Additionally, Microsoft announced a $10 billion multi-year investment in OpenAI.

Overall, these factors indicate a bright future outlook for ChatGPT and suggest positive prospects for its stock.

What's the Potential Impact of Dall-E 3 Release on ChatGPT Stock?

OpenAI has unveiled Dall-E 3, a cutting-edge advancement in its series of text-to-image AI tools. This latest iteration offers a significant leap in capabilities, allowing users to generate images that are not only detailed but also contextually relevant based on the text prompts provided. One of the standout features of Dall-E 3 is its seamless integration with ChatGPT, OpenAI’s widely recognized chatbot. This integration means that users can now leverage ChatGPT’s conversational abilities to refine and guide the image generation process, making the tool more interactive and user-friendly.

The release of Dall-E 3 is a testament to OpenAI’s commitment to pushing the boundaries of AI-driven content creation. By combining the textual prowess of ChatGPT with the visual capabilities of Dall-E 3, OpenAI is poised to offer a holistic content creation solution that could revolutionize industries ranging from design and advertising to entertainment and education.

However, the journey is not without challenges. OpenAI has introduced enhanced safeguards in Dall-E 3 to prevent the generation of inappropriate or offensive content. This move reflects the company’s dedication to ethical AI usage, ensuring that the tool is not only powerful but also responsible. On the legal front, there are emerging concerns around the copyright status of AI-generated content. Recent court rulings have indicated that artworks created solely by AI without human intervention might not be eligible for copyright protection. This raises questions about the ownership and commercial use of images generated by Dall-E 3.

Furthermore, the AI landscape is becoming increasingly competitive. Tech giants like Alibaba and Meta are stepping up their game, introducing tools that rival OpenAI’s offerings. OpenAI also faces legal disputes from prominent authors who claim that ChatGPT was trained on their copyrighted works without permission.

In conclusion, while Dall-E 3’s release and its integration with ChatGPT solidify OpenAI’s position as a leader in AI-driven content creation, the company will need to navigate a complex mix of legal, ethical, and competitive challenges. However, given the unparalleled value that the combined capabilities of Dall-E 3 and ChatGPT bring to the table, OpenAI stands to make a significant impact in the AI domain.

ChatGPT and Microsoft Stock: The Impact of Altman's Firing

Impact on ChatGPT:

- Leadership Change: Altman’s departure from OpenAI, where he was a prominent figure, could initially create uncertainty around the direction and leadership of ChatGPT. As a key figure in OpenAI, Altman was instrumental in driving the vision and strategy for ChatGPT. His firing and the subsequent appointment of Emmett Shear as interim CEO might lead to changes in strategic priorities or shifts in the developmental focus of ChatGPT.

- Innovation Continuity: Despite the change in leadership, the core team and technology behind ChatGPT remain intact. This suggests that while there might be some initial disruption, the long-term innovation trajectory of ChatGPT is likely to continue. The technology’s foundational aspects and ongoing projects are expected to progress under the new leadership.

- Market Perception: The sudden nature of Altman’s departure could raise concerns among stakeholders and partners about the stability and governance within OpenAI. This might affect the market’s confidence in ChatGPT in the short term, although the impact could be mitigated if the new leadership quickly establishes its credibility and outlines a clear future roadmap.

Impact on Microsoft’s Stock:

- Strategic Acquisition: Microsoft hiring Altman and Brockman to lead a new advanced AI research team is a strategic move. This could be perceived positively by the market, as it brings renowned AI leaders into Microsoft’s fold, potentially bolstering its AI capabilities and future innovations.

- Investor Confidence: The move might boost investor confidence in Microsoft’s commitment to leading in AI technology. Altman’s expertise and leadership in AI, combined with Microsoft’s resources, could accelerate AI developments, benefiting Microsoft’s long-term strategic positioning in the AI market.

- Market Dynamics: While there might be initial volatility in Microsoft’s stock due to the high-profile nature of these changes, the long-term impact is likely to be positive. The integration of Altman and Brockman’s expertise could enhance Microsoft’s competitive edge in AI, potentially leading to new product developments and market opportunities.

In conclusion, while Altman’s firing from OpenAI introduces some uncertainty for ChatGPT, the technology’s foundational strength and ongoing projects are likely to sustain its growth trajectory. For Microsoft, the hiring of Altman and Brockman is a strategic enhancement to its AI capabilities, likely to be viewed positively by investors and the market in the long term.

Sora: The Dawn of AI-Generated Video

Sora, OpenAI’s groundbreaking text-to-video AI model, represents a significant leap in artificial intelligence capabilities. It can generate realistic and imaginative videos from text instructions, creating scenes that range from everyday moments to the fantastical. This innovation is not just about visual storytelling; it’s a step towards understanding and simulating the physical world in motion. Here’s why Sora’s introduction is a watershed moment:

- Revolutionizing Content Creation: Sora democratizes video production, enabling creators to bring their visions to life without the need for expensive equipment or specialized skills.

- Enhancing Real-World Interaction: By simulating real-world interactions, Sora has the potential to aid in problem-solving and educational tools, making complex concepts more accessible.

- Pushing AI Boundaries: Sora’s ability to generate complex scenes with accurate details and emotions pushes the envelope of what AI can achieve, setting new standards for AI creativity.

- Investment Implications for ChatGPT: Sora underscores OpenAI’s leadership in AI innovation, potentially increasing investor confidence and interest in ChatGPT and related technologies. It highlights the expanding capabilities of AI, suggesting a future where AI can generate not just text but comprehensive multimedia content.

Despite its advancements, Sora faces challenges, such as accurately simulating physics and managing complex interactions. However, OpenAI’s commitment to safety and continuous improvement suggests a path forward that balances innovation with responsibility.

Conclusion

Overall, the continuous innovation of ChatGPT in the field of artificial intelligence and the proof of its impact on the market make it a very attractive investment opportunity. However, like any investment, understanding the potential risks is key. Only when you have a thorough understanding of how ChatGPT operates and its position in the market can you make an informed investment decision.