7 Best AI Stocks to Watch in Q1 2024

As we step into the first quarter of 2024, the realm of Artificial Intelligence (AI) continues to evolve at a breathtaking pace. The integration of AI into various sectors has not only revolutionized traditional practices but also opened new avenues for investors. In this article, we delve into the seven AI stocks that are making significant strides in this domain and are worth watching.

This article explores the top seven AI stocks to watch in Q1 2024, focusing on companies like Microsoft, Nvidia, Alphabet, Tesla, Baidu, C3.ai, and SoundHound AI Inc. It discusses their roles in AI development, market trends, and investment strategies in the AI sector.

7 AI Stocks You Should Watch

Name | Stock Symbol | Market Cap | Price |

|---|---|---|---|

Microsoft | MSFT | $2.79T | $376.04 |

Nvidia | NVDA | $1.22T | $495.22 |

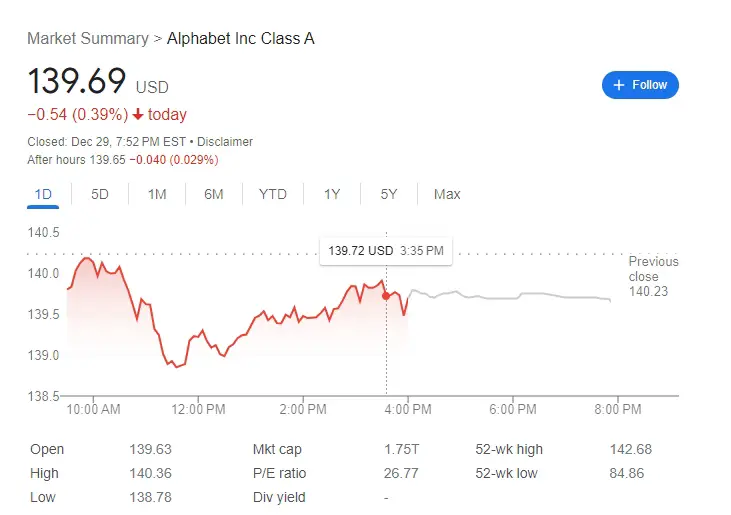

Alphabet | GOOGL | $1.75T | $139.69 |

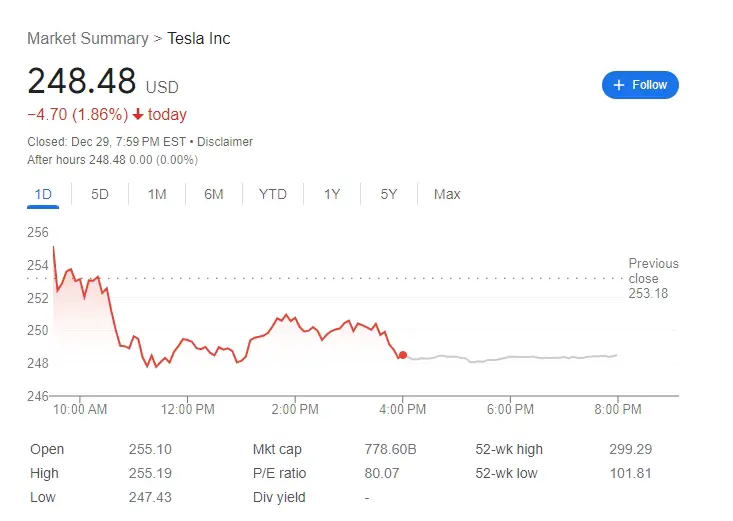

Tesla | TSLA | $778.6B | $248.48 |

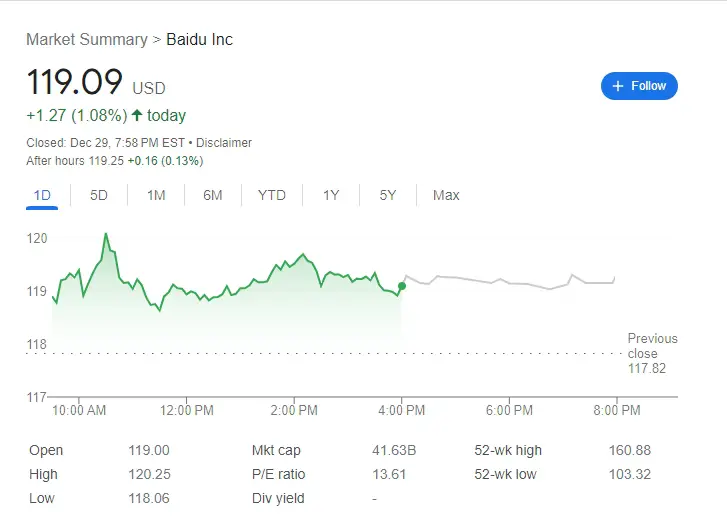

Baidu | BIDU | $41.63B | $119.09 |

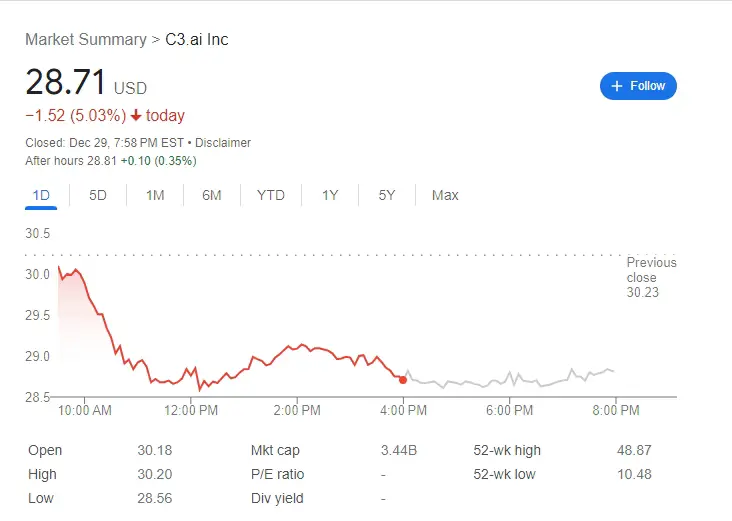

C3.ai | AI | $3.44B | 28.71 |

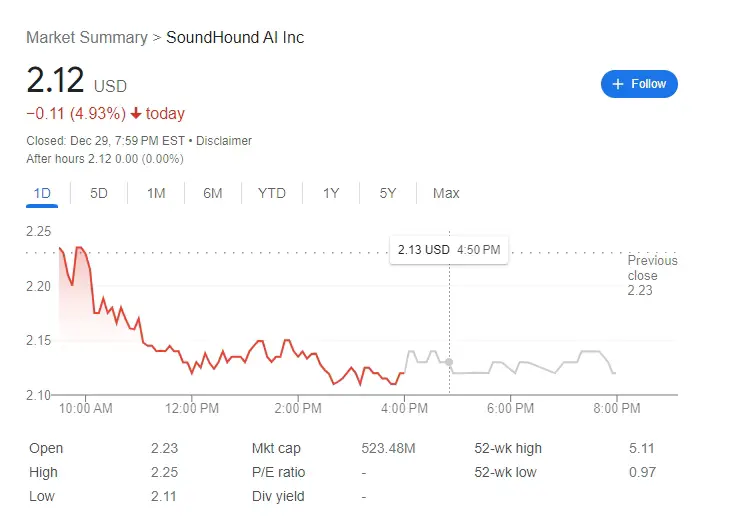

SoundHound AI Inc | SOUN | $523.48M | $2.12 |

1. Microsoft

Microsoft, a global computing powerhouse, has firmly positioned itself in the AI landscape. In 2023, the company’s strategic partnership with OpenAI, particularly in the development of ChatGPT, marked a significant milestone. This collaboration, coupled with a substantial $10 billion investment in OpenAI, underscores Microsoft’s commitment to AI innovation. The integration of AI into Microsoft’s cloud services and its search engine Bing is a strategic move to challenge Google’s dominance in the search market. The potential IPO of OpenAI, speculated to be around $90 billion, could further amplify Microsoft’s influence in the AI sector. Microsoft’s AI initiatives are not just limited to corporate growth but are also focused on enhancing user experience and productivity, making it a compelling stock to watch. The company’s AI-driven analytics and cloud computing services are expected to continue driving growth, positioning Microsoft as a leader in AI innovation for the foreseeable future.

2. Nvidia

Nvidia, renowned for its cutting-edge graphics processing units (GPUs), has become a key player in AI. In 2023, Nvidia’s GPUs were integral in powering AI and deep learning applications across various industries, from gaming to autonomous vehicles. The company’s stock has seen significant growth, reflecting its pivotal role in AI development. Nvidia’s AI-focused hardware, particularly its deep learning chips, are in high demand for AI applications, making it a valuable asset in the AI market. The company’s strategy to continually innovate and lead in high-performance AI computing has kept it at the forefront of AI technology. Nvidia’s partnerships with major tech companies for AI applications further solidify its market position. Looking ahead, Nvidia’s ongoing commitment to AI and machine learning, along with its robust R&D, positions it as a strong contender in the AI space, making its stock a compelling choice for AI-focused investors.

3. Alphabet

Nvidia, renowned for its cutting-edge graphics processing units (GPUs), has become a key player in AI. In 2023, Nvidia’s GPUs were integral in powering AI and deep learning applications across various industries, from gaming to autonomous vehicles. The company’s stock has seen significant growth, reflecting its pivotal role in AI development. Nvidia’s AI-focused hardware, particularly its deep learning chips, are in high demand for AI applications, making it a valuable asset in the AI market. The company’s strategy to continually innovate and lead in high-performance AI computing has kept it at the forefront of AI technology. Nvidia’s partnerships with major tech companies for AI applications further solidify its market position. Looking ahead, Nvidia’s ongoing commitment to AI and machine learning, along with its robust R&D, positions it as a strong contender in the AI space, making its stock a compelling choice for AI-focused investors.

4. Tesla

Tesla, primarily known for its electric vehicles (EVs), has made significant strides in AI, particularly in autonomous driving technology. In 2023, Tesla’s focus on integrating AI into its EVs, including the development of fully autonomous driving capabilities, highlighted its commitment to innovation. Tesla’s AI advancements extend beyond automotive to projects like the Optimus humanoid robot, showcasing its ambition in robotics. Despite facing challenges, such as economic slowdowns and legal issues, Tesla’s AI initiatives have continued to progress. The company’s vision for AI in transportation and robotics positions it as a unique player in the AI space. Tesla’s potential expansion into new markets, coupled with its ongoing AI developments, makes its stock an intriguing option for investors interested in AI and technology. The company’s ability to integrate AI into its products and services, along with its visionary leadership, positions Tesla as a stock to watch in the evolving AI landscape

5. Baidu

Baidu, often referred to as “China’s Google,” is a leading Chinese multinational technology company specializing in Internet-related services, AI, and technology. In 2023, Baidu made significant strides in AI, particularly in natural language processing and autonomous driving technologies. The company’s AI-driven search engine continues to dominate the Chinese market, while its foray into AI cloud services and autonomous driving solutions, like Apollo, positions it as a frontrunner in China’s AI race. Baidu’s development of its AI chatbot, Ernie Bot, is a direct response to global AI trends, showcasing its capability to innovate in the AI space. The company’s focus on AI research and development, coupled with its strong market presence in China, makes Baidu a compelling stock for investors looking at AI growth in the Asian market. Baidu’s future prospects in AI look promising, with potential expansions in AI applications across various sectors, including healthcare and smart cities.

6. C3.ai

C3.ai, a relatively smaller yet significant player in the AI market, specializes in AI software and services for enterprise applications. In 2023, C3.ai continued to expand its footprint by providing AI solutions to large-scale industries, including energy, manufacturing, and financial services. The company’s AI platform enables businesses to develop, deploy, and operate enterprise-scale AI applications, driving digital transformation. C3.ai’s collaboration with major industry players and its focus on scalable AI solutions have positioned it as an innovative force in enterprise AI. The company’s stock is particularly attractive to investors looking for exposure to AI applications in enterprise settings. C3.ai’s growth trajectory in 2023, marked by its expanding client base and innovative AI solutions, indicates a promising future. The company’s focus on leveraging AI for practical business applications and its continuous investment in R&D make it a stock to watch in the enterprise AI sector.

7. SoundHound AI Inc

SoundHound AI Inc, a company specializing in voice-enabled AI and conversational intelligence technologies, has carved a niche for itself in the AI market. In 2023, SoundHound’s advancements in voice AI technology, particularly in voice recognition and natural language understanding, have been noteworthy. The company’s AI platform is used in various applications, from automotive voice assistants to smart consumer devices, highlighting its versatility. SoundHound’s partnerships with major corporations across different industries underscore its capability to integrate AI into diverse environments. The stock is attractive for investors interested in the growing field of voice AI and its applications in everyday technology. SoundHound’s potential for growth in the voice AI market, along with its innovative approach to conversational AI, makes it a unique investment opportunity in the AI sector.

AI Stocks: OpenAI Crisis

The AI sector, while burgeoning with opportunities, faced a significant challenge in 2023 with the OpenAI crisis. The rapid advancement and widespread adoption of AI technologies, particularly large language models like ChatGPT, sparked debates over ethical concerns, job displacement, and the societal impact of AI. This crisis highlighted the need for responsible AI development and governance. Investors became increasingly aware of the risks associated with AI investments, including regulatory challenges and public backlash against AI technologies perceived as harmful or invasive.

The OpenAI crisis served as a wake-up call for the industry to prioritize ethical AI practices and transparent governance. For investors, this underscored the importance of considering ethical and societal implications when investing in AI stocks. The crisis also opened discussions about the long-term sustainability of AI technologies and the need for balanced growth that aligns with societal values and norms. As the AI sector navigates these challenges, companies that demonstrate a commitment to ethical AI practices and responsible innovation are likely to gain investor confidence, shaping the future trajectory of AI investments

How to invest in AI stocks?

Investing in AI stocks requires a strategic approach, blending knowledge of technology trends with traditional investment principles. As AI transforms industries, it presents unique opportunities and risks. Investors should consider various factors, including market trends, company performance, technological advancements, and ethical considerations in AI development. Here are some key strategies to consider when investing in AI stocks:

Research and Understand the Companies

Before investing, thoroughly research and understand the companies you are interested in. Look into their AI projects, market position, financial health, and growth potential. Companies leading in AI innovation, like Microsoft and Nvidia, often have a strong market presence and continuous investment in AI research and development. However, smaller companies like C3.ai or SoundHound AI Inc might offer higher growth potential but come with greater risks. Understanding a company’s AI strategy, its role in the AI ecosystem, and its long-term vision is crucial.

Diversify Your AI Stock Portfolio

Diversification is key in managing risk, especially in a volatile and rapidly evolving sector like AI. Instead of focusing on a single stock, consider a mix of companies with different sizes and roles in the AI market. This could include large tech companies with AI divisions, specialized AI firms, and companies in industries heavily influenced by AI, such as automotive or healthcare. Diversification helps mitigate the risk associated with any single company or sector.

Stay Informed on AI Trends and Developments

AI is a fast-evolving field, and staying informed about the latest trends and developments is crucial. This includes technological breakthroughs, regulatory changes, and market shifts. Keeping abreast of these changes can help you make informed decisions and identify emerging opportunities or risks in your AI investments.

Consider Ethical and Social Implications

The ethical and social implications of AI are increasingly important to consider. Companies that prioritize responsible AI practices and address ethical concerns may be better positioned for long-term success. Investors should consider how a company’s AI applications impact society and whether they align with ethical standards and regulations.

How to find AI ETFs?

Investing in AI through Exchange-Traded Funds (ETFs) is a way to gain exposure to a diversified portfolio of AI stocks. ETFs can provide a balanced investment in the AI sector without the need to pick individual stocks. Here’s how to find and evaluate AI ETFs:

Research AI-Focused ETFs

Start by researching ETFs that specifically focus on AI and technology. Look for ETFs that track AI indexes like the Indxx Global Robotics & Artificial Intelligence Thematic Index or the Nasdaq CTA Artificial Intelligence & Robotics Index. These ETFs invest in a basket of companies involved in AI development and implementation, offering a diversified exposure to the AI sector.

Evaluate the ETF’s Holdings and Performance

Examine the ETF’s holdings to understand which companies it invests in and how diversified it is. Check the performance history of the ETF to assess how it has managed market volatility and compare its returns against relevant benchmarks. It’s also important to consider the ETF’s expense ratio, as higher fees can impact your overall returns.

Consider the ETF’s Investment Strategy

Different AI ETFs may have varying investment strategies. Some might focus on large-cap tech companies with AI divisions, while others might invest in smaller, pure-play AI firms. Understanding the ETF’s investment strategy will help you align it with your investment goals and risk tolerance.

Stay Updated on AI Market Trends

Just like individual AI stocks, the AI sector as a whole is subject to rapid changes. Stay informed about the broader trends and developments in AI, as these can impact the performance of AI ETFs. Regularly reviewing and adjusting your ETF investments in response to market changes can be a prudent strategy.

Also read:3 AI Stocks You Should Buy July 2023

Conclusion:

The AI sector presents exciting opportunities for investors. The companies discussed here are at the forefront of AI innovation and offer a glimpse into the future of technology and investment. As AI continues to evolve, staying informed and strategically investing in this sector will be key to capitalizing on its growth potential.