3 AI Stocks You Should Buy July 2023

The world of Artificial Intelligence (AI) is growing at an unprecedented rate, with advancements and applications in various sectors such as healthcare, finance, transportation, and more. Investing in AI stocks is a strategic move to capitalize on this growth. This article will introduce three AI stocks that are worth considering for investment in July 2023.

3 AI Stocks You Should Buy

Name | Stock Symbol | Market Cap | Price |

|---|---|---|---|

Zebra Technologies | ZBRA | $15.56B | $302.59 |

Arista Networks | ANET | $52.94B | $171.72 |

Honeywell International | HON | $139.34M | $209.32 |

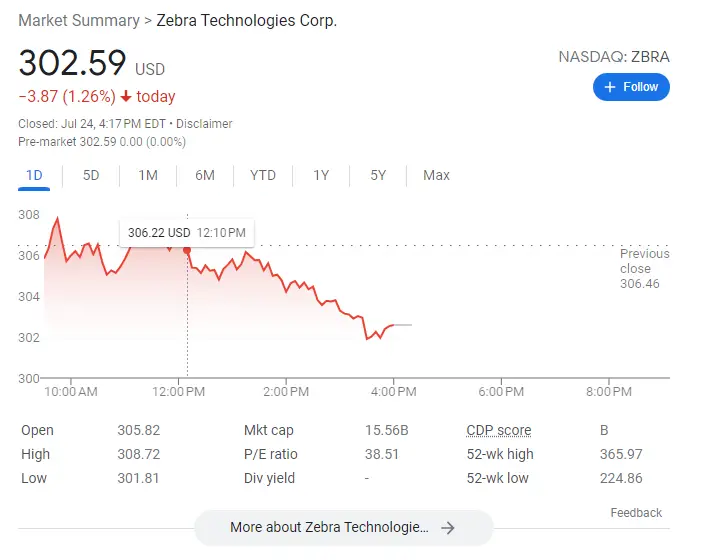

1. Zebra Technologies (ZBRA)

Zebra Technologies is a company that specializes in making tracking technology and solutions that generate actionable information and insights. The company’s stock has been performing well, with a 52-week range of $382.18 – $541.79. The recent trend shows a steady increase in the stock price, indicating a positive market sentiment towards the company. Zebra Technologies has a strong market cap of $28.23 billion, which is a testament to its stability and growth potential. The company’s recent acquisition of Fetch Robotics, a pioneer in on-demand automation, further strengthens its position in the AI sector.

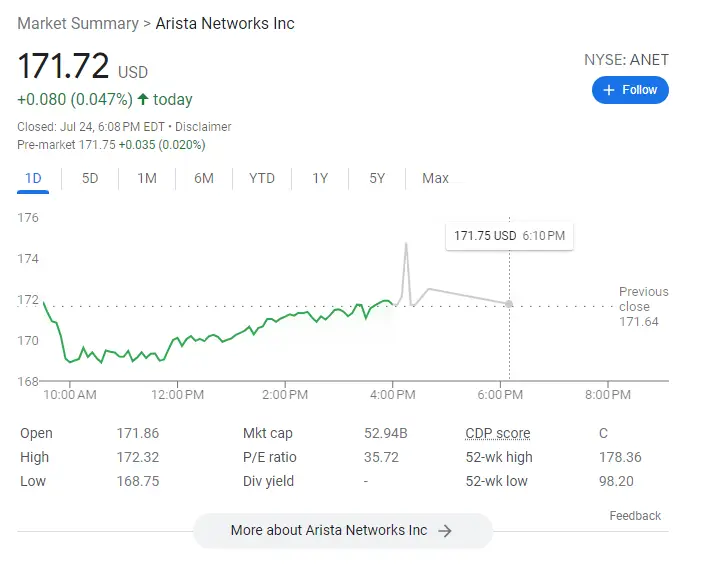

2. Arista Networks (ANET)

Arista Networks is a leader in cloud networking and has a significant presence in the AI industry. The company’s stock has been on an upward trend, with a 52-week range of $276.12 – $410.37. Arista Networks has a robust market cap of $31.31 billion, indicating its strong market position and potential for growth. The company’s recent performance has been impressive, with a 5.5% gain in the last trading session, outpacing the S&P 500. Arista’s commitment to delivering software-driven cloud networking solutions for large data center and campus environments makes it a promising AI stock.

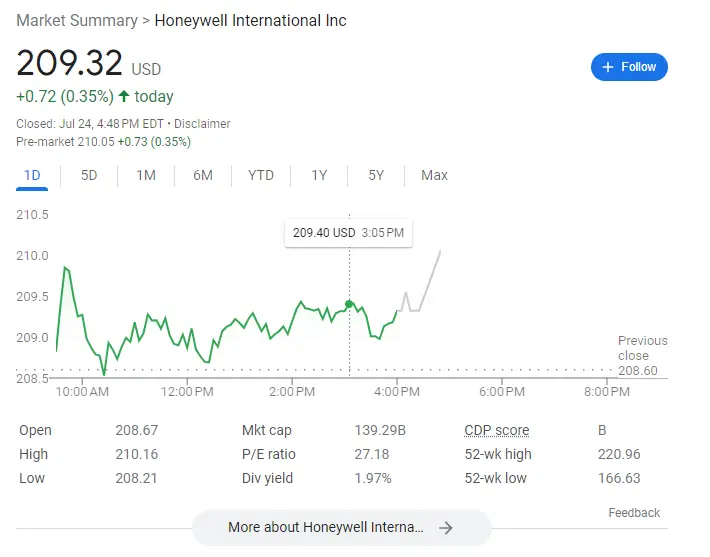

3. Honeywell International (HON)

Honeywell International is a diversified technology and manufacturing company with a strong presence in the AI sector. The company’s stock has been performing well, with a 52-week range of $166.63 – $220.96. Honeywell has a substantial market cap of $139.34 billion, indicating its stability and potential for growth. The company’s stock has seen a third consecutive day of gains, and it operates in various sectors, including aerospace, building technologies, and safety and productivity solutions, all of which have applications for AI.

How to invest in AI stocks?

- Identify the Leaders: Look for companies that are leading in AI research and development. For instance, Zebra Technologies Corporation (NASDAQ: ZBRA) is a leading digital solution provider enabling businesses to intelligently connect data, assets, and people. They are expected to release their Q2 2023 financial results soon, and analysts are optimistic about their performance.

- Understand the Business Model: It’s crucial to understand how the company makes money and how AI fits into their business model. Arista Networks (ANET), a cloud networking company, has seen its shares gain 15.33% over the past month, outpacing the Computer and Technology sector’s gain of 2.6%. The company is expected to post earnings of $1.44 per share in its next earnings release, marking year-over-year growth of 33.33%.

- Consider the Financial Health: Look at the company’s financial health, including its earnings, revenue, and growth projections. For example, Honeywell International Inc. (HON) has seen its stock price inch higher, despite underperforming the market. The company’s stock closed $11.64 below its 52-week high, which it reached on November 25th.

- Diversify: Don’t put all your eggs in one basket. Diversify your portfolio by investing in different AI companies across various sectors. This can help mitigate risk and potentially increase returns.

Also read:What is Leiapix Converter Stock and How to Invest it?

The State of Technology Stocks

- Strong Performance: Technology stocks have generally been performing well, with companies like Arista Networks outpacing the gains in the broader Computer and Technology sector.

- AI and Tech Intersection: AI is becoming an integral part of many technology companies. For instance, Zebra Technologies is leveraging AI to intelligently connect data, assets, and people.

- Future Growth: The future growth prospects for technology stocks look promising, especially for those incorporating AI into their operations. Arista Networks, for instance, is expected to see year-over-year growth of 33.33% in its next earnings release.

- Market Volatility: Despite the strong performance, technology stocks can be subject to market volatility. Honeywell International Inc., for example, has seen its stock price fluctuate, underperforming the market at times.

Conclusion:

Investing in AI stocks is a strategic move to capitalize on the growth of the AI industry. Zebra Technologies, Arista Networks, and Honeywell International are three AI stocks that show promising growth potential and stability. As with any investment, it’s crucial to conduct thorough research and consider various factors before investing.