3 AI Stocks You Should Sell July 2023

As we navigate the ever-evolving landscape of artificial intelligence (AI), it’s crucial to stay informed about the performance of AI stocks. While some companies are making strides in this sector, others may not be living up to their hype. This article will delve into three AI stocks that, based on current market trends and company performance, you might want to consider selling in July 2023.

Learn more:How to Invest AI Stock ?10 Best AI Stocks in 2023.

3 AI Stocks You Should Sell

Name | Stock Symbol | Market Cap | Price |

|---|---|---|---|

C3.ai | AI | $4.41B | $38.17 |

Upstart | UPST | $4.43B | $53.64 |

SoundHound AI | SOUN | $634.79M | $2.92 |

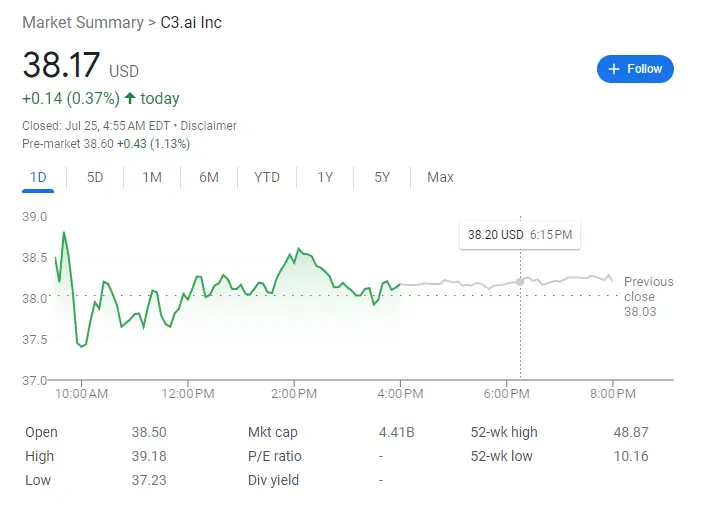

1. C3.ai (AI)

C3.ai has been a prominent player in the AI market, with its shares jumping more than 250 percent in 2023. However, despite this impressive growth, there are concerns about the company’s future. The company’s subscription revenue has been essentially flat over the past few quarters, and while they’re improving profitability, they’re still burning money.

Moreover, there’s been a significant turnover in the CFO role at C3.ai, with the company having had four CFOs since 2019. This frequent change in financial leadership raises questions about the company’s stability.

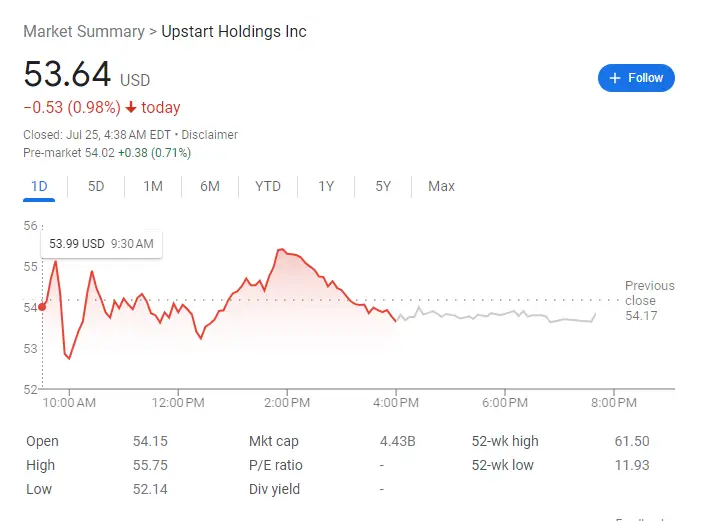

2. Upstart (UPST)

Upstart, a fintech company focusing on AI-driven lending, saw its share price surge tenfold in 2021. However, the company’s performance couldn’t justify its peak share price of $400, causing a more than 90% drop in its stock value. In the last quarter, the company’s revenue and total loan disbursements fell by 67% and 78% respectively, resulting in an operating loss of $132 million. Upstart has yet to prove the market demand and profitability of its AI-driven loans.

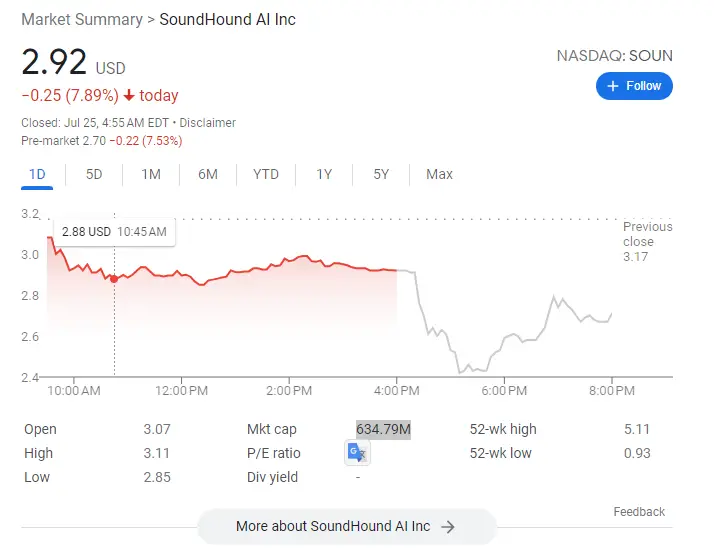

3. SoundHound AI (SOUN)

SoundHound AI develops AI-powered voice tools and solutions. Despite a high daily trading volume of 15 million shares, the actual product value may be inflated by market speculation. Last year’s revenue was only $31 million, predicted to grow to $45 million this year, but the company is expected to continue incurring losses until at least 2025. Although the share price is low, due to a large number of shares in circulation, the actual market value is close to $700 million – an overpriced tag for a small loss-making company.

How to invest in AI stocks?

Investing in AI stocks requires a keen understanding of the technology and the company’s business model. It’s crucial to research the company’s financial health, market position, and growth potential. Always diversify your portfolio and consider the risk associated with investing in tech stocks.

Also read:What is Leiapix Converter Stock and How to Invest it?

Conclusion:

While AI presents a significant market opportunity, not all companies in this sector are guaranteed to succeed. It’s essential to stay informed and make investment decisions based on thorough research and market trends. The three AI stocks mentioned in this article have shown signs that might warrant a sell-off, but as always, investors should conduct their due diligence.