What is NVIDIA Stock Price And How to Buy NVIDIA Stock?

In the ever-evolving world of technology, the stock market offers a plethora of opportunities for investors to dive into the future. Among the tech giants, NVIDIA has been a name that resonates with innovation, especially in the realm of artificial intelligence (AI). But as any seasoned investor would tell you, understanding a stock goes beyond its name recognition. In this comprehensive guide, we’ll delve deep into NVIDIA, its stock, and potential alternatives, ensuring you’re well-equipped to make an informed decision. So, buckle up as we embark on this financial journey!

From NVIDIA’s dominance in the GPU market to its potential alternatives like Palantir, this guide provides a deep dive into the investment opportunities in the AI sector. Discover the reasons behind the stock trends, the financial health of these tech giants, and the future prospects that could shape your investment decisions.

Table of Contents

What is NVIDIA Stock?

NVIDIA, a tech giant known for its graphics processing units (GPUs), has been a significant player in the tech industry since its inception. Its stock has been a topic of interest for many investors, given the company’s innovative strides in the AI and gaming sectors.

See more:AI Chip Ban: A Storm Brewing for AMD and Nvidia Stocks?

What is NVIDIA?

NVIDIA’s journey began in 1993, founded by Jen Hsun Huang, Chris A. Malachowsky, and Curtis R. Priem. Headquartered in Santa Clara, CA, the company has been at the forefront of computer graphics, chipsets, and multimedia software.

Origins and Mission

NVIDIA’s mission has always been to push the boundaries of what’s possible in the realm of graphics and AI. Their GPUs have transformed the gaming industry, and their ventures into AI have set new industry standards.

Approach to AGI

NVIDIA’s approach to artificial general intelligence (AGI) is marked by its commitment to innovation and research. Their GPUs are not just for gaming; they’re driving supercomputing for autonomous robots, drones, cars, and more.

Team and Collaborations

With a team of dedicated professionals and collaborations with tech giants, NVIDIA is always a step ahead in the tech race. Recent news highlights their collaborations and partnerships in various sectors, emphasizing their influence and reach.

What is NVIDIA's Stock Name?

NVIDIA’s stock trades under the ticker “NVDA” on the NASDAQ. As of the latest data, the stock price stands at $451.70.

What is NVIDIA Stock Price?

The stock price, as mentioned, is $451.70, with a market cap of a whopping $1.13T.

What is NVIDIA's Stock Symbol?

For those looking to invest, remember the ticker symbol: NVDA.

Who owns NVIDIA Stock?

NVIDIA’s stock is publicly traded, meaning it’s owned by institutional investors, retail investors, and the company’s executives.

How to Invest in NVIDIA Stock?

Investing in NVIDIA is not just about buying a piece of the tech industry; it’s about being part of a revolution. NVIDIA, with its groundbreaking technologies in AI and gaming, offers a promising avenue for investors. But how does one go about it?

Understanding the Basics

Before diving in, it’s crucial to understand the basics of stock trading. This involves knowing the difference between market orders, limit orders, and stop orders. Additionally, familiarize yourself with terms like dividends, earnings per share, and P/E ratios. These basics provide a foundation for your investment journey.

Choosing the Right Brokerage

There are numerous online brokerages available today, each with its own set of features and fees. Research and choose one that aligns with your investment goals and offers a seamless trading experience. Some popular options include E*TRADE, Robinhood, and TD Ameritrade.

Monitoring and Diversifying

Once invested, it’s essential to monitor your stocks. Stay updated with NVIDIA’s quarterly reports, industry trends, and global economic factors that might impact stock performance. Additionally, while NVIDIA is a strong contender, diversifying your portfolio can help mitigate risks.

NVIDIA IPO

NVIDIA’s Initial Public Offering (IPO) might be in the past, but it’s a significant event that shaped its journey in the stock market. Let’s delve deeper.

The Historical Significance

NVIDIA’s IPO in 1999 was a game-changer. Priced at $12 per share, the company raised a significant amount, setting the stage for its future endeavors in the tech world. The IPO provided NVIDIA with the capital to innovate and expand.

Market Response

The market’s response to NVIDIA’s IPO was overwhelmingly positive. Investors recognized the potential of the company’s GPU technology, and the stock saw substantial growth in the subsequent years.

Long-Term Implications

The success of the IPO solidified NVIDIA’s position in the market. It gave the company the financial muscle to invest in R&D, leading to innovations that have since become industry standards.

NVIDIA's Financial Health

A company’s financial health is a critical indicator for investors. Let’s assess NVIDIA’s financial standing.

Current Financial Standing

With a market cap surpassing $1 trillion, NVIDIA stands tall among tech giants. Its consistent revenue growth, coupled with strategic investments, paints a picture of financial stability.

Debt Management

NVIDIA’s approach to debt management has been commendable. The company has maintained a low debt-to-equity ratio, ensuring that it doesn’t over-leverage itself and can weather economic downturns.

Future Projections

Analysts remain bullish on NVIDIA’s future. With its ventures into AI, cloud computing, and continued dominance in the GPU market, NVIDIA’s financial trajectory looks promising for the foreseeable future.

Alternatives to Invest NVIDIA Stock

While NVIDIA remains a dominant force in the tech world, especially in the realm of AI and GPUs, there are other tech giants and emerging players that offer promising returns for investors. Let’s explore some alternatives to NVIDIA and understand their significance in the AI domain and their recent stock market performance.

Name | Stock Symbol | Market Cap | Price | Past 6 Months |

|---|---|---|---|---|

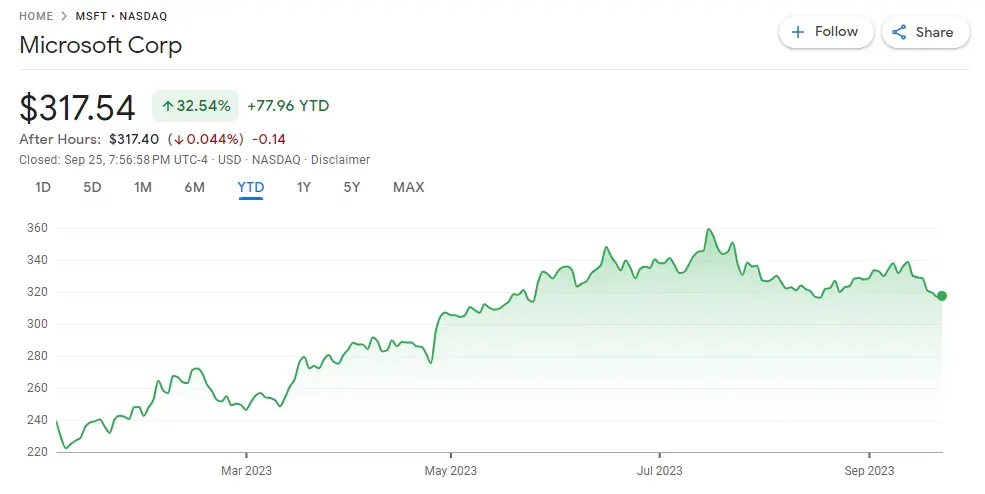

Microsoft | MSFT | $2.51T | $329.82 | +41.16 (14.89%) |

Palantir | PLTR | $37.88B | $17.61 | +9.22 (109.89%) |

Alphabet | GOOGL | $1.66T | $138.42 | +28.65 (27.96%) |

1. Microsoft ( MSFT )

Microsoft, a tech behemoth, has been making significant strides in the AI domain. Their cloud platform, Azure, offers a suite of AI tools and services that cater to businesses of all sizes. With the acquisition of companies like Nuance Communications, Microsoft is further solidifying its position in AI-driven healthcare solutions. Recently, MSFT stocks have seen a steady rise, reflecting the company’s robust business model and its adaptability in the ever-evolving tech landscape.

2.Palantir(PLTR)

Palantir Technologies has carved a niche for itself in the realm of data analytics and artificial intelligence. Their data mining platform is designed to aggregate and analyze data from various sources, aiding organizations in making informed decisions. Palantir’s Gotham platform, which serves as the default OS for data for the U.S. military and other government agencies, has been instrumental in significant operations, including tracking down Osama Bin Laden.

3. Alphabet (GOOGL)

Alphabet, the parent company of Google, has been at the forefront of AI innovations. From self-driving cars to healthcare solutions, Alphabet’s subsidiaries are leveraging AI in groundbreaking ways. DeepMind, an Alphabet subsidiary, has achieved remarkable feats in AI, including the development of AlphaGo, which defeated the world champion in the game of Go. GOOGL stocks have been performing well, reflecting the company’s continuous innovations and its dominant position in multiple tech sectors.

Reasons to invest in NVIDIA?

NVIDIA, a name synonymous with cutting-edge technology, has been a beacon for investors looking for robust returns. But what makes NVIDIA such an attractive investment option? Let’s delve deeper into the compelling reasons.

Dominance in the GPU Market

NVIDIA’s Graphics Processing Units (GPUs) have revolutionized the gaming industry. But beyond gaming, these GPUs are now pivotal in AI computations, data centers, and supercomputing, making NVIDIA a leader in multiple tech domains.

Pioneering AI Innovations

NVIDIA isn’t just about hardware. Their software frameworks, like CUDA, have become industry standards in AI research and development. Their commitment to AI has positioned them at the forefront of this tech revolution.

Financial Stability and Growth

With consistent revenue growth, strategic acquisitions, and a low debt profile, NVIDIA’s financial health is robust. Their growth trajectory, coupled with a strong market position, makes them a promising investment.

NVIDIA news

Staying updated with the latest happenings around NVIDIA can provide insights into its market position and future potential. Here’s a roundup of recent NVIDIA news.

Strategic Collaborations and Partnerships

NVIDIA’s recent collaborations span various sectors. From partnering with automakers for autonomous driving solutions to joining hands with tech giants for cloud computing, NVIDIA is expanding its influence and reach.

Research Breakthroughs and Innovations

NVIDIA’s research labs are always buzzing with innovations. Recent breakthroughs include advancements in ray tracing technology, AI-driven healthcare solutions, and more, further solidifying NVIDIA’s position as a tech innovator.

Expansion into New Markets

Beyond GPUs and AI, NVIDIA is venturing into new territories. Their acquisition of Arm, a semiconductor and software design company, indicates NVIDIA’s ambitions to be a holistic tech solutions provider.

Conclusion:

NVIDIA’s stock offers a glimpse into the future of tech. Its innovations, market position, and growth potential make it a top choice for investors. Whether you’re a seasoned investor or a newbie, NVIDIA is a stock worth considering.