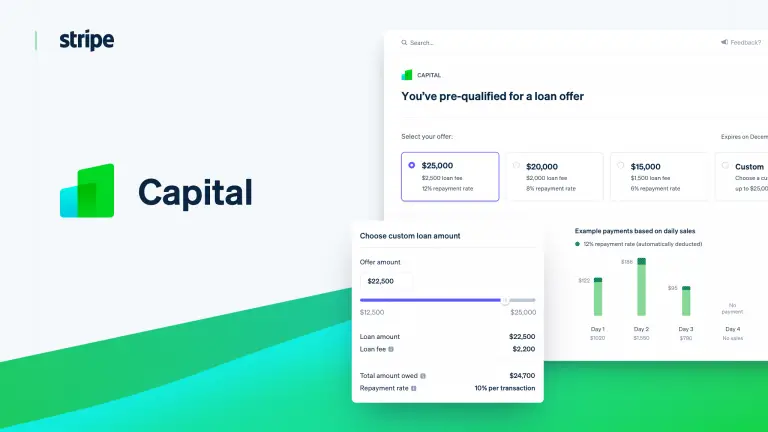

Stripe Capital: AI Loan Tool That Automates Repayments

What is Stripe Capital?

Stripe Capital is a loan service platform developed by Stripe on September 5th, 2019, which provides loans to users. Its mission is to provide fast and flexible loans to businesses, especially small and medium-sized enterprises, to help them grow. With Stripe Capital, there is no need for credit checks or lengthy application processes. The platform offers an end-to-end loan API that allows flexible access to dynamic business loan conditions, and can automatically deduct corresponding funds based on users’ sales, achieving loan repayment automation.

Price: No uniform price

Tag: AI Loan Tool

Release time: September 5, 2019

Developer(s): Stripe

Users: 49M

Share Stripe Capital

Stripe Capital Features

- Quick application: It is very simple for users to obtain funds in Stripe Capital, without personal credit checks and complicated applications.

- Funds arrive quickly: Stripe Capital allows users to quickly obtain funds. After the application is approved, the funds requested by the user will usually be credited to their Stripe account on the next working day.

- Fixed fee: Users only need to pay a fixed fee when using Stripe, and there is no need to pay fees repeatedly or fulfill certain mortgage obligations.

- Repayment automation: When users use Stripe’s funds to make profits, Stripe will automatically collect the corresponding funds from the sales, and the amount charged will be adjusted according to the user’s sales to realize automatic repayment.

How to Login Stripe Capital?

- Enter the Stripe Capital website, click “Sign in” in the upper right corner.

- Enter your Stripe Capital account email and password.

- Then click “Continue” to successfully log in.

- If you do not have a Stripe Capital account, you can click “Sign up” below.

- Then enter your email address, region and password as prompted.

- Finally click “Create account” to get your Stripe Capital account.

How to Use Stripe Capital?

Stripe Capital has various functions, and there is no unified usage procedure. You can check account information, check balance, learn about related products, apply for funds or use other functions after logging in.

Stripe Capital Pricing

Stripe Capital’s fees are not fixed. If your business has a relatively large transaction volume and transaction volume, please contact Stripe Capital staff, and they will provide you with greater discounts.

Plan | Pay-as-you-go | Customized |

|---|---|---|

Price | 2.9% | Contact sales |

Functions |

|

|

Stripe Capital Reviews

Andrew: It is really convenient to apply for funds at Stripe Capital, without having to do a personal credit check, saving a lot of time and effort!

Benson: Stripe Capital really makes sense for businesses!

Cherry: Stripe Capital is so practical and helped me a lot.

FAQ

Stripe Capital is a lending platform, similar platforms include Siftery, Bonsai, Unstack, etc.

There are no credit checks for loans at Stripe Capital, which is designed to provide businesses with fast and flexible lending

Authoritative Information

- Stripe, Inc.-Wikipedia (February 22, 2023)