What is a Fintech Chatbot?A Guide to Get You Up to Speed!

In the dynamic world of financial technology, AI tools like fintech chatbots have emerged as game-changers, reshaping the interaction between customers and financial services. These advanced AI-driven chatbots are not just software programs but sophisticated tools designed to mimic human conversation, offering an interactive and personalized experience. With the integration of cutting-edge technologies such as natural language processing and machine learning, fintech chatbots are capable of handling a wide array of financial tasks — from responding to customer inquiries to executing transactions and providing tailored financial advice. Their role extends beyond mere customer service; they serve as vital components in the financial ecosystem, improving operational efficiency, enhancing customer engagement, and providing valuable insights into consumer behavior. The advent of these AI tools marks a significant leap in the financial sector, offering an innovative, efficient, and user-friendly approach to managing financial interactions.

Fintech chatbots are revolutionizing the financial sector, offering enhanced customer service, operational efficiency, and strategic insights. They balance innovative AI capabilities with necessary security and privacy measures, navigating the challenges of automation in the workforce. As this technology continues to evolve, its impact on the financial industry is increasingly significant, redefining customer engagement and business strategy.

Table of Contents

What is a Fintech Chatbot?

Fintech chatbots are AI-powered tools designed to interact with users in the financial services sector. They are programmed to simulate human conversation, providing responses to customer queries, facilitating transactions, and offering financial advice. These chatbots use technologies like natural language processing (NLP) and machine learning to understand and respond to user requests in a conversational manner. Their development is driven by the need to enhance customer service and streamline operations in the financial industry. By integrating with existing banking systems, fintech chatbots can access and process customer data, making them highly effective for personalized communication and service.

The capabilities of fintech chatbots extend far beyond simple question-and-answer interactions. They are adept at performing a variety of financial tasks, such as checking account balances, initiating payments, and even providing investment advice. Advanced chatbots can analyze spending patterns to offer personalized budgeting advice or detect unusual account activity for fraud prevention. Their ability to handle complex tasks is continually improving, thanks to advancements in AI and machine learning algorithms. This level of functionality makes fintech chatbots invaluable tools for both individual customers seeking convenient financial management and businesses aiming to enhance their customer engagement.

In the broader financial ecosystem, fintech chatbots play a pivotal role in transforming customer service and operational efficiency. They offer a scalable solution to handle high volumes of customer interactions, which is particularly beneficial for banks and financial institutions with a large customer base. By providing immediate responses to customer inquiries, chatbots significantly reduce wait times and improve overall user experience. They also serve as an effective medium for financial education, offering users insights into various financial products and services. In addition, the continuous interaction with customers provides financial institutions with valuable data, which can be used to tailor services, improve customer satisfaction, and inform business strategies.

Also read :10 Best Telegram AI Chatbots You Need to Know in 2023

Key Features of Fintech Chatbot

Advanced AI Capabilities

- Natural Language Processing (NLP): Fintech chatbots leverage NLP to understand and interpret human language, allowing them to comprehend customer queries and respond naturally.

- Understands various dialects and colloquialisms.

- Improves over time through machine learning.

- Machine Learning Algorithms: These algorithms enable chatbots to learn from interactions, enhancing their ability to provide accurate responses and predictions.

- Personalized interactions by learning user preferences.

- Identifies patterns in customer behavior for better service.

Personalized Customer Interactions

- User Data Analysis: Chatbots analyze user data to offer tailored financial advice and product recommendations.

- Creates a personalized experience for each user.

- Suggests relevant financial products and services based on user history.

- Adaptive Interactions: The chatbot adapts its communication style based on the customer’s profile and past interactions.

- Adjusts tone and language complexity for different users.

- Remember past interactions for continuity in conversation.

24/7 Availability and Scalability

- Round-the-Clock Service: Unlike human staff, fintech chatbots are available 24/7, providing constant support to customers across different time zones.

- Reduces wait times for customer queries.

- Ensures constant engagement, even outside business hours.

- Scalability: Chatbots can handle a vast number of interactions simultaneously, scaling as per demand without additional costs.

- Manages high volumes of queries without compromising quality.

- Efficiently handles peak times like financial year-ends.

Integration with Financial Systems

- Seamless System Integration: Fintech chatbots integrate smoothly with existing banking and financial systems for a unified customer experience.

- Accesses customer accounts and transaction histories for accurate information.

- Processes transactions and executes commands within secure protocols.

- Compliance and Security: Chatbots adhere to financial regulations and security standards, ensuring safe and compliant interactions.

- Employs encryption and secure channels for data protection.

- Regularly updated to comply with evolving financial regulations.

How to Login Fintech Chatbot?

Step 1: Account Creation and Verification

Creating an account is the first gateway to accessing a fintech chatbot. Typically, this process begins on the financial institution’s website or mobile app. Here, you’ll be prompted to provide essential information like your name, email address, and possibly financial details. The chatbot might guide you through this process, making it interactive and less daunting.

- Information Submission: Enter your personal and financial details as requested. Accuracy here is crucial to ensure smooth future transactions.

- Verification Process: This step often involves verifying your email or phone number. A code might be sent to your chosen medium, which you’ll need to enter to proceed. This verification is a security measure to protect your financial data and identity.

Step 2: Customizing User Preferences

Once your account is set up and verified, the next step is to customize your preferences. This personalization enhances your experience, allowing the chatbot to serve you better based on your specific needs and interests.

- Setting Preferences: You may be asked about your financial goals, preferred transaction methods, and notification settings. This data helps the chatbot tailor its services to your individual requirements.

- Privacy Settings: It’s essential to adjust your privacy settings at this stage. Decide how much data you are comfortable sharing and under what circumstances.

Step 3: Secure Authentication

Security is paramount in any financial interaction. Fintech chatbots ensure robust authentication mechanisms to protect your account and transactions.

- Strong Authentication Methods: These may include passwords, PINs, biometric data, or two-factor authentication (2FA). Choose the method that offers convenience and high security.

- Regular Updates: Regularly update your authentication details to maintain security. The chatbot might prompt you to change your passwords or PINs periodically.

How to Use a Fintech Chatbot?

Step 1: Initiating Conversations

To start using a fintech chatbot, you usually begin by typing a message or selecting an option from a menu. The chatbot will then respond, guiding you through various services.

- Starting the Interaction: Simply type in your query or select an option. For example, you could type “Check account balance” or select it from a menu.

- Understanding the Interface: Familiarize yourself with the chat interface. It may have buttons for common commands or a text box for typing questions.

Step 2: Navigating Features

Fintech chatbots offer a range of features, from viewing transaction history to getting financial advice. Navigating these features is crucial for a fulfilling experience.

- Exploring Options: Look through the different options available. These might include transaction history, fund transfers, investment advice, etc.

- Interactive Guidance: If unsure, ask the chatbot for help. Say something like, “How do I transfer funds?” and the chatbot will guide you through the process.

Step 3: Getting Assistance and Support

Lastly, understanding how to get assistance and support is vital. If you encounter issues or have queries, the chatbot is there to help.

- Asking for Help: Simply type in your query, like “I need help with my account statement,” and the chatbot will provide assistance or direct you to the right resource.

- Escalating Issues: If the chatbot can’t solve your problem, it will usually escalate the issue to a human representative. This ensures that more complex issues are handled efficiently.

Best use cases of fintech chatbots

Customer Service and Support

Fintech chatbots excel in providing customer service and support, transforming the way financial institutions interact with clients. These AI-driven chatbots offer instant responses to customer inquiries, significantly reducing wait times and improving overall customer satisfaction.

- Instant Query Resolution: Whether it’s a question about account balance, transaction status, or service-related information, chatbots can provide immediate answers, enhancing user experience.

- 24/7 Availability: Unlike traditional customer service, fintech chatbots are available around the clock, ensuring customers get the help they need anytime, anywhere.

- Handling High Volume of Requests: During peak times, chatbots can handle a large volume of simultaneous requests without compromising the quality of service.

Transaction Handling and Alerts

Chatbots in the fintech sector streamline transaction processes and alert customers about important account activities, making banking more efficient and user-friendly.

- Facilitating Transactions: Users can execute basic transactions like fund transfers, bill payments, and account updates through simple chatbot commands.

- Real-time Alerts: Chatbots send real-time alerts for significant account activities like large withdrawals, suspicious transactions, or approaching payment deadlines, enhancing security and awareness.

- Transaction History: Customers can easily inquire about their past transactions, gaining quick access to their financial history through the chatbot interface.

Financial Advice and Planning

One of the most innovative uses of fintech chatbots is providing personalized financial advice and planning assistance, making financial management more accessible to a broader audience.

- Tailored Financial Advice: Based on the user’s financial behavior and goals, chatbots can offer customized advice on savings, investments, and budget management.

- Retirement and Investment Planning: Chatbots can guide users in planning for long-term goals like retirement, providing insights on investment options and savings strategies.

- Market Updates: For users interested in stock markets or cryptocurrencies, chatbots can provide timely market updates and news, aiding in informed investment decisions.

Personalized Product Recommendations

Fintech chatbots can analyze customer data to recommend financial products and services that align with individual needs and preferences, enhancing the customer experience.

- Customized Product Suggestions: Based on a user’s financial history and goals, chatbots can suggest relevant financial products like loans, insurance, or investment schemes.

- Interactive Product Exploration: Users can interactively explore different products through the chatbot, asking questions and receiving detailed information tailored to their interests.

- Simplifying Product Selection: By offering tailored recommendations, chatbots simplify the decision-making process for customers, helping them choose products that best suit their financial situation.

Pros &Cons of Fintech Chatbot

Efficiency and Cost-Effectiveness

One of the most significant advantages of fintech chatbots is their efficiency and cost-effectiveness. These AI-powered tools handle a vast number of queries simultaneously, significantly reducing the need for a large customer service team.

High Efficiency: Chatbots can manage thousands of interactions at once, providing quick responses to common queries.

- Reduces response time for customer inquiries.

- Enhances customer satisfaction through efficient service.

Cost Reduction: By automating routine tasks, chatbots cut down on operational costs.

- Reduces labor costs associated with customer service.

- Lowers the expenses of training and maintaining a large staff.

Challenges and Limitations

Despite their benefits, fintech chatbots also face certain challenges and limitations, particularly in handling complex queries and maintaining a personal touch.

Handling Complex Queries: Chatbots sometimes struggle with complex or non-standard customer issues.

- May require human intervention for complicated problems.

- Risk of misunderstanding or misinterpreting customer queries.

Lack of Personalization: While chatbots offer personalized responses, they can lack the empathy and understanding of a human agent.

- May not fully understand emotional cues.

- Can seem impersonal, especially in sensitive financial matters.

Impact on Employment in Finance

The integration of chatbots in fintech also raises concerns about the impact on employment, particularly in customer service roles.

Reduction in Traditional Roles: Automation may lead to a decrease in certain job types, especially those focused on routine customer service tasks.

- May result in job displacement for some roles.

- Requires workforce to adapt and upskill for new technological demands.

Creation of New Opportunities: On the flip side, chatbots also create new job opportunities in AI, machine learning, and chatbot development.

- Opens up roles in AI maintenance and improvement.

- Creates demand for professionals skilled in AI oversight and ethical considerations.

Why Use a Fintech Chatbot for Your Business?

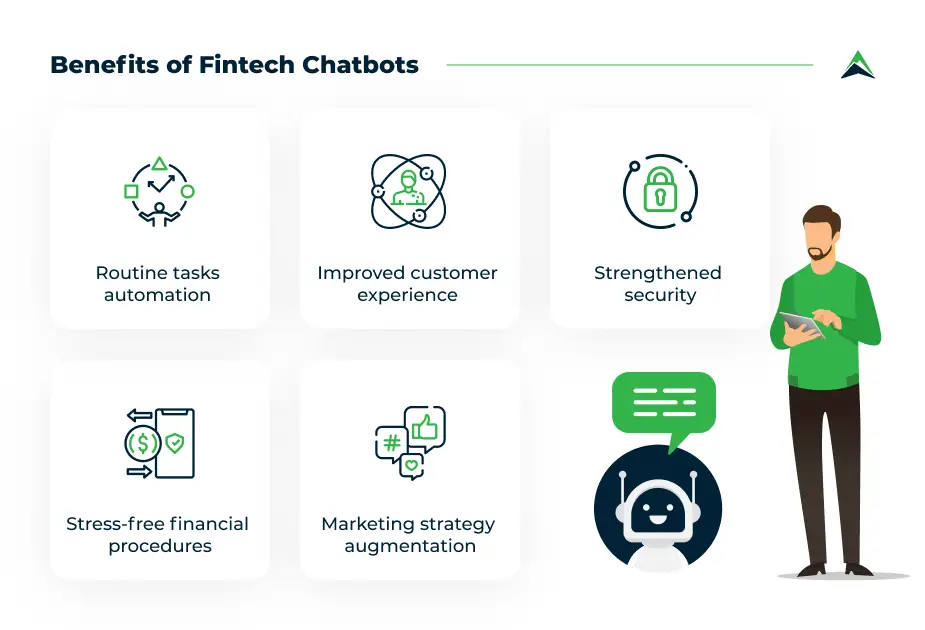

Fintech chatbots play a pivotal role in enhancing customer experience, a key factor in retaining and attracting clients in the competitive financial sector.

- Immediate Response: Chatbots provide instant responses to customer queries, significantly reducing wait times and improving overall satisfaction.

- Personalized Interactions: By leveraging user data, chatbots offer personalized advice and services, making each customer feel valued and understood.

- 24/7 Availability: Offering round-the-clock assistance, chatbots ensure that customer support is available anytime, enhancing the brand’s reliability and trustworthiness.

The implementation of fintech chatbots leads to more streamlined operations, allowing businesses to focus on core activities and strategic growth.

- Automating Routine Tasks: Chatbots efficiently handle routine inquiries and transactions, freeing up human resources for more complex tasks.

- Data Management: They adeptly manage and analyze large volumes of customer data, providing valuable insights for business strategy and decision-making.

- Reduced Operational Costs: By automating customer service, chatbots significantly reduce operational costs associated with staffing and infrastructure.

In the rapidly evolving fintech sector, chatbots offer businesses a significant competitive advantage.

- Innovation Perception: Adopting chatbot technology portrays a brand as innovative and forward-thinking, appealing to tech-savvy customers.

- Scalability: Chatbots can easily scale up to handle increased customer interactions during peak times, ensuring consistent service quality.

- Market Intelligence: They collect and analyze customer data, offering insights into market trends and customer preferences, crucial for staying ahead in the market.

How Fintech Chatbots Benefit Brands?

Fintech chatbots significantly contribute to building a positive brand image and establishing customer trust.

- Brand Differentiation: Innovative chatbot services can differentiate a brand from competitors, showcasing a commitment to customer-centric innovation.

- Trust Through Reliability: Consistent and accurate assistance builds customer trust, a crucial factor in financial services where trust is paramount.

- Enhanced Customer Engagement: Interactive and engaging chatbot experiences lead to higher customer engagement and loyalty.

Chatbots open up new avenues in marketing and sales, enabling brands to reach and engage customers more effectively.

- Cross-selling and Upselling: Intelligent chatbots can identify opportunities to recommend additional products or services, increasing sales potential.

- Targeted Marketing: They can deliver personalized marketing messages based on customer interaction history and preferences.

- Lead Generation: Chatbots can qualify leads by gathering preliminary information, making the sales process more efficient.

The ability of fintech chatbots to gather and analyze data is invaluable for business growth and strategy.

- Customer Behavior Insights: Chatbots gather data on customer preferences and behavior, offering insights for product development and business strategies.

- Feedback Collection: They can solicit and collect customer feedback in real-time, providing immediate insights into customer satisfaction and areas for improvement.

- Market Trend Analysis: Analyzing customer interactions and queries can help identify emerging market trends and customer needs, enabling proactive business decisions.

Is it Safe to Use a Fintech Chatbot ?

Security Measures

Fintech chatbots are designed with a variety of security measures to protect user data and ensure safe transactions. These measures are crucial in maintaining the integrity and trustworthiness of financial services.

- Data Encryption: All communication between the user and the chatbot is encrypted, ensuring that sensitive information like account details and transaction records are secure.

- Regular Security Updates: Chatbots are regularly updated to address new security threats and vulnerabilities, keeping them resilient against cyber attacks.

- Compliance with Regulations: Fintech chatbots comply with financial industry standards and regulations, such as GDPR and PCI DSS, to ensure data protection and privacy.

Privacy Concerns

While fintech chatbots are secure, privacy concerns remain a significant consideration, especially regarding how user data is handled and stored.

- Data Collection and Use: Chatbots collect personal and financial data to provide services. It’s essential that this data is used responsibly and transparently.

- User Consent and Control: Users typically have control over their data, including what is shared and how it’s used. Clear consent mechanisms are in place to ensure user privacy.

- Anonymization Techniques: Many chatbots employ data anonymization techniques, ensuring that personal information cannot be traced back to individual users.

Reliability and Trustworthiness

The reliability and trustworthiness of fintech chatbots hinge not only on their technical security features but also on the user’s perception of their safety.

- Consistent and Accurate Responses: Reliable chatbots provide consistent and accurate financial information and advice, building user trust.

- Transparency in Operations: Being transparent about how the chatbot functions and what limitations it has helps in establishing trust.

- User Education and Support: Educating users on safe practices while using chatbots, and providing robust support in case of issues, further enhances trustworthiness.

Conclusion

Fintech chatbots represent a significant advancement in the realm of financial technology, offering a plethora of benefits that cater to both businesses and consumers. They enhance customer experiences through 24/7 availability, personalized interactions, and efficient handling of routine tasks. For businesses, they not only streamline operations and reduce costs but also open up new avenues for marketing, sales, and data-driven decision-making. While the efficiency, scalability, and innovative edge they provide are undeniable, it’s important to consider the challenges they pose, especially in terms of employment impact and the need for human empathy in complex customer interactions. The question of safety and privacy in using fintech chatbots is addressed through robust security measures, adherence to privacy regulations, and continuous efforts to improve reliability and user trust. As the financial sector continues to evolve, fintech chatbots stand out as pivotal tools, reshaping how financial services are delivered and experienced, while also highlighting the need for ongoing improvements in AI technology and ethical considerations.