LK-99 and AMSC Stock: An In-Depth Analysis of Market Reaction

The scientific community and financial markets alike are abuzz with the recent announcement of LK-99, a material claimed to exhibit superconductivity at room temperature. This development has not only stirred the scientific community but also caused significant ripples in the financial markets. One company that has been at the center of this financial storm is American Superconductor (NASDAQ: AMSC), whose stock price surged following the announcement of LK-99. This article aims to dissect this market reaction and provide a comprehensive understanding of the situation.

Table of Contents

What is AMSC Stock?

AMSC, or American Superconductor Corporation, is a company that provides megawatt-scale power solutions that improve the performance of the power grid and lower the cost of wind power. The company operates through two segments: Grid and Wind. The Grid segment enables electric utilities and renewable energy project developers to connect, transmit, and distribute power with efficiency, reliability, security, and affordability. The Wind segment permits the manufacturers to field wind turbines with power output, reliability, and affordability.

Why Should You Invest in AMSC?

Investing in AMSC could be a strategic move for those interested in the renewable energy sector. The company’s focus on improving the performance of the power grid and reducing the cost of wind power makes it a key player in the renewable energy industry. Moreover, the company’s recent stock performance shows significant growth, indicating a positive market response.

Who Owns AMSC Stock?

The detailed information about the ownership of AMSC stock is not provided in the source. However, it is generally owned by a mix of institutional investors, mutual funds, and individual investors.

What is AMSC Stock Price?

As of August 2, 2023, the closing price of AMSC stock was $11.46. However, in after-hours trading, the stock price fell to $10.12, a decrease of 11.69%.

What is AMSC Stock Symbol?

The stock symbol for American Superconductor Corporation is AMSC. It is traded on the NASDAQ exchange.

How to Buy AMSC Stock?

To buy AMSC stock, you would need to have a brokerage account. You can choose from a variety of online brokers that allow you to buy and sell stocks on major exchanges. After setting up your account, you can place an order to buy AMSC stock.

Invest in Alternatives of AMSC Stock

Name | Stock Symbol | Market Cap | Price | Rise and Fall in Past 6 Months |

|---|---|---|---|---|

Bruker Corp. | BRKR | $10.3B | $70.95 | -1.57 (-2.16%) |

Woodward Inc. | WWD | $7.67B | $127.75 | +23.91 (23.03%) |

Franklin Electric Co. Inc. | FELE | $4.52B | $97.41 | +3.54 (3.77%) |

Powell Industries Inc | POWL | $726.94M | $85.54 | +39.72 (86.69%) |

AZZ Inc. | AZZ | $1.12B | $44.34 | +1.00 (2.31%) |

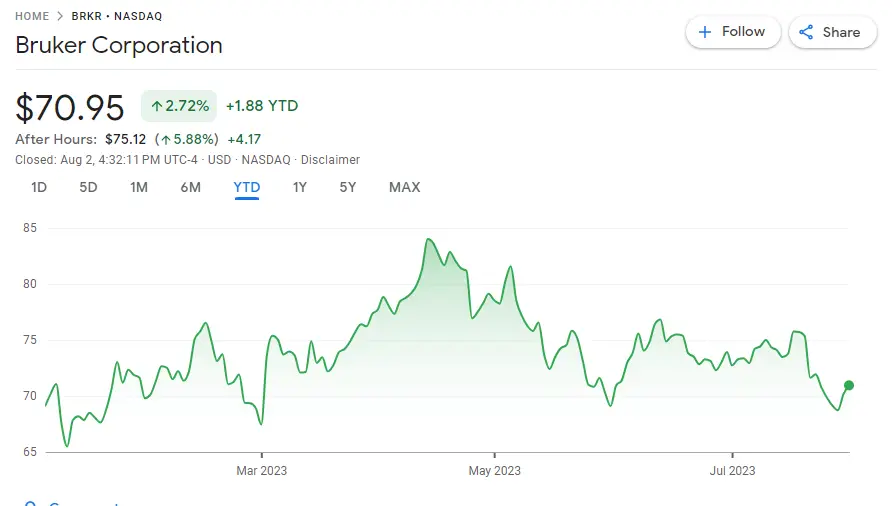

1.Bruker Corporation (BRKR)

Bruker Corporation is a leading global manufacturer of scientific instruments, focusing on providing high-performance scientific instruments, research, biomedical, application, and diagnostic solutions for researchers. Recently, the company’s stock has been steadily rising, mainly due to its continuous investment and innovation in the field of scientific research. Investing in Bruker Corporation’s stock is wise due to its leading position in scientific research and medical fields, as well as its continuous investment in innovation and R&D.

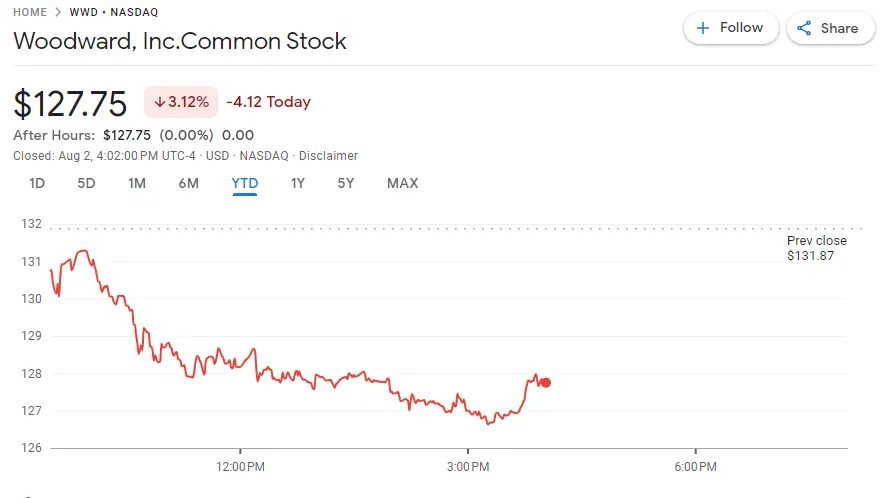

2.Woodward, Inc. (WWD)

Woodward, Inc. is a leading global company in the design, manufacture, and service of systems and components, providing energy control and optimization solutions for the aerospace and industrial markets. The company’s stock has shown steady growth over the past few months, mainly due to its strong position in the aerospace and industrial markets. Investing in Woodward, Inc.’s stock is wise due to the company’s leading position in its markets and its continuous investment in technological innovation and R&D.

3.Franklin Electric Co., Inc. (FELE)

Franklin Electric Co., Inc. is a leading global manufacturer of motors and controls, serving consumers, industrial, and commercial markets worldwide. The company’s stock has shown steady growth over the past few months, mainly due to its strong position in the field of motor and control manufacturing. Investing in Franklin Electric Co., Inc.’s stock is wise due to the company’s leading position in its markets and its continuous investment in technological innovation and R&D.

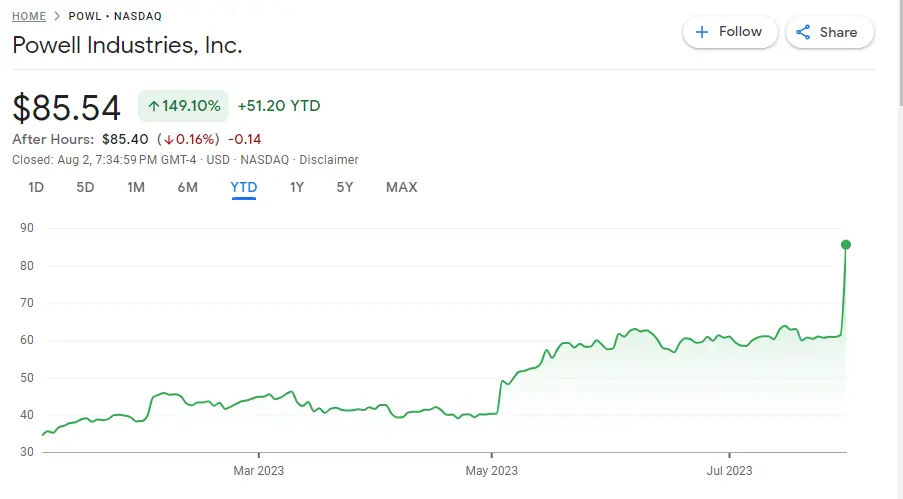

4.Powell Industries, Inc. (POWR)

Powell Industries, Inc. is a leading global provider of energy solutions, focusing on serving the global power, industrial, and oil and gas markets. The company’s stock has shown steady growth over the past few months, mainly due to its strong position in the field of energy solutions. Investing in Powell Industries, Inc.’s stock is wise due to the company’s leading position in its markets and its continuous investment in technological innovation and R&D.

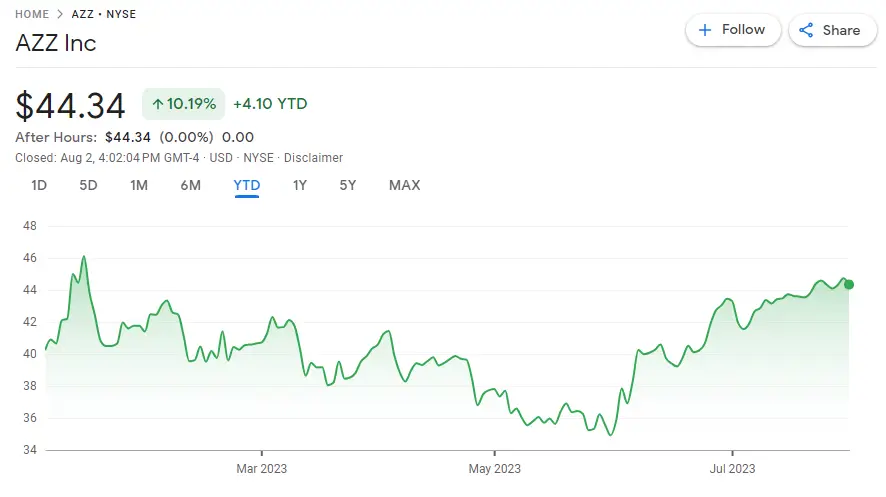

5.AZZ Inc. (AZZ)

AZZ Inc. is a leading global provider of metal coating services, serving the global power generation, transmission, distribution, and industrial markets. The company’s stock has shown steady growth over the past few months, mainly due to its strong position in the field of metal coating services. Investing in AZZ Inc.’s stock is wise due to the company’s leading position in its markets and its continuous investment in technological innovation and R&D.

The LK-99 Superconductor: A Revolutionary Claim

LK-99, a lead-based compound, is purportedly a room-temperature, ambient-pressure superconductor. If true, this discovery would be one of the biggest ever in condensed matter physics, with huge implications for energy generation and transmission, transport, computing, and other areas of technology.

Superconductors are materials that can conduct electricity with zero resistance, making them highly efficient for a variety of applications. However, most superconductors only exhibit these properties at extremely low temperatures, making them impractical for many uses. The claim that LK-99 can exhibit superconductivity at room temperature and ambient pressure would, if confirmed, represent a significant breakthrough in the field.

However, it’s important to note that this is still a claim, not a fact. The original post from a Korean team at the Quantum Energy Research Centre has sparked wild enthusiasm online, but it has also raised eyebrows among physicists due to its lack of detail.

The AMSC Stock: A Case of Nominative Indeterminism?

American Superconductor, a company that provides a range of power electronics and software-based control systems, saw its shares surge following the announcement of LK-99. However, it’s crucial to understand that AMSC has no interest in – it doesn’t own any of – this new superconductor if it does exist. In fact, if the new room temperature superconductor does exist, it could do significant damage to American Superconductor’s line of business, as it would to pretty much every extant operator in the electricity distribution business.

The surge in AMSC’s stock price seems to be a case of nominative indeterminism. As word leaked out of a world-changing – possibly – technology, people started to look for ways to make money out of it. And there was a company with “superconductor” in the name. This led to a surge in the company’s stock price, but as soon as people realize that AMSC has nothing to do with this new technology, it’s likely that the stock price will correct itself.

The Market Reaction: A Lesson in Caution

The market reaction to the announcement of LK-99 and its impact on the AMSC stock serves as a lesson in caution for investors. It’s crucial to understand that investing based on the name of a company or a current trend without understanding the underlying fundamentals can lead to significant losses.

While the discovery of a room-temperature superconductor could indeed be revolutionary, it’s important to separate the potential impact of this discovery on the broader market from its impact on individual companies. For instance, while a room-temperature superconductor could revolutionize the energy sector by making power transmission more efficient, it doesn’t necessarily mean that every company with “superconductor” in its name will benefit from this development.

The Future of Superconductivity and the Financial Markets

The announcement of LK-99 has undoubtedly caused a stir in both the scientific and financial worlds. While the potential of a room-temperature superconductor is exciting, it’s crucial to approach such developments with a healthy dose of skepticism and a thorough understanding of the market.

As for the AMSC stock, only time will tell whether the recent surge was a temporary blip or a sign of things to come. Investors should keep a close eye on the developments surrounding LK-99 and the verification of its claimed properties. They should also be wary of making investment decisions based solely on trends or buzzwords, as these can often lead to inflated stock prices that don’t reflect the true value of a company.

Also read:Why Tesla Stock Falls Again Today?Lastest Tesla Stock News

Conclusion

The story of LK-99 and the AMSC stock is a fascinating case study in the intersection of science and finance. It serves as a reminder of the potential impact of scientific discoveries on the financial markets, but also of the dangers of speculation and misinformation. As the story continues to unfold, it will be interesting to see how the scientific community and the financial markets respond to the ongoing developments.