BigBear AI's Stock Soars: Unpacking the Drivers

In a remarkable turn of events, BigBear AI’s stock has witnessed a significant surge, capturing the attention of investors and market analysts alike. This upward trajectory in the stock market is not just a testament to the company’s robust performance but also highlights the burgeoning interest in AI-driven solutions across various sectors.

Unpack the drivers behind BigBear AI’s soaring stock, from AI sector enthusiasm to the company’s cutting-edge solutions and strategic market position.

Table of Contents

Introduction to BigBear AI's Recent Surge

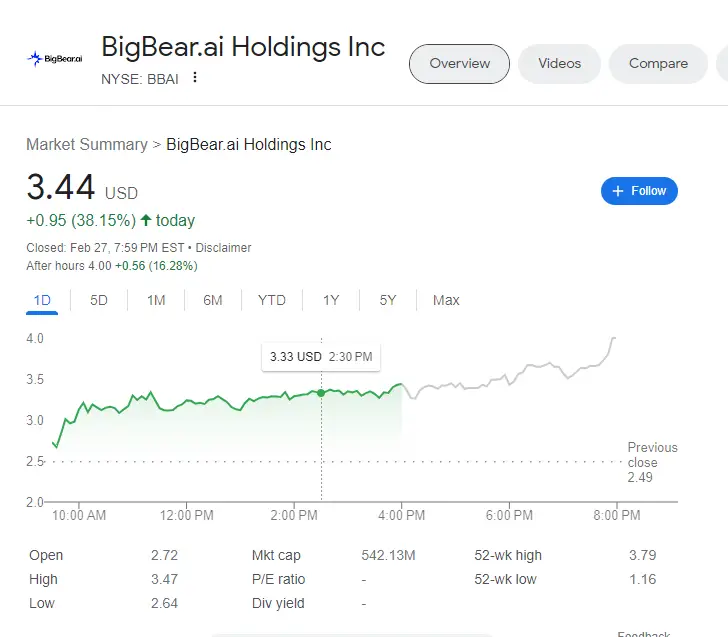

BigBear AI, a leading provider of AI-powered decision intelligence solutions, has seen its stock price skyrocket, with a notable increase of over 50% in just two days. This surge is attributed to the heightened volatility among AI-related companies, spurred by Nvidia’s impressive fourth-quarter earnings report. BigBear AI’s expertise in supply chains, logistics, autonomous systems, and cybersecurity positions it as a key player in the AI space, benefiting from the sector’s overall momentum.

What is BigBear AI?

BigBear AI is a company at the forefront of delivering AI-powered decision intelligence solutions tailored for government and defense, manufacturing and warehouse operations, and healthcare and life sciences. With a focus on enhancing decision-making and operational execution, BigBear AI leverages advanced AI and machine learning capabilities to address some of the most complex challenges faced by its clients.

Understanding the Surge in BigBear AI Stock

Sector-Wide AI Enthusiasm

The AI sector’s enthusiasm, particularly following Nvidia’s success, has played a crucial role in propelling BigBear AI’s stock. The company’s alignment with the broader AI advancements and its ability to offer cutting-edge solutions have made it a beneficiary of the sector’s positive sentiment.

BigBear AI’s Diverse Service Offering

BigBear AI’s broad range of services, from consultation to big data analytics and cybersecurity, ensures its relevance across multiple industries. This diversity not only enhances its market position but also attracts investors looking for comprehensive AI solutions providers.

Market Dynamics and Trading Volume

The dynamic trading associated with BigBear AI’s stock, coupled with a significant trading volume, suggests a growing investor interest. This interest is further amplified by the short interest in the stock, indicating a speculative aspect to the stock’s movement.

Key Drivers Behind BigBear AI's Performance

- AI Sector Growth: The global AI sector’s rapid growth, with a projected CAGR of 36.8% by 2030, underscores the vast potential for companies like BigBear AI.

- Innovative Solutions: BigBear AI’s innovative AI-driven solutions in critical areas like cybersecurity and autonomous systems contribute to its strong market position.

- Strategic Partnerships: Collaborations with industry leaders and government agencies enhance BigBear AI’s credibility and market reach.

Analyzing BigBear AI's Market Position

BigBear AI’s ascent in the AI landscape is underscored by its strategic market positioning and innovative solutions. As the company navigates the complexities of the AI sector, its unique offerings and strategic alliances have carved a niche, setting it apart from competitors.

Strategic Alliances and Partnerships

BigBear AI’s collaborations with leading tech firms and government agencies have bolstered its market credibility. These partnerships not only enhance its service offerings but also expand its reach into critical sectors like defense and healthcare, where AI’s impact is transformative.

Specialization in Decision Intelligence

At the heart of BigBear AI’s market position is its specialization in decision intelligence solutions. This focus on providing AI-powered insights for complex decision-making processes resonates with industries facing intricate challenges, positioning BigBear AI as a go-to solution provider.

Expansion into Emerging Markets

BigBear AI’s foray into emerging markets and sectors underscores its strategic approach to growth. By tapping into new industries and geographies, the company is broadening its market base, ensuring sustained growth in the rapidly evolving AI landscape.

BigBear AI's Financial Highlights

BigBear AI’s financial performance is a testament to its operational efficiency and strategic market positioning. The company’s financial highlights reflect its growth trajectory and commitment to innovation in the AI sector.

Revenue Growth and Diversification

A key highlight of BigBear AI’s financial performance is its consistent revenue growth, fueled by diversification into new markets and sectors. This growth is indicative of the company’s ability to adapt and thrive in the dynamic AI market.

Investment in Research and Development

BigBear AI’s significant investment in research and development underscores its commitment to staying at the forefront of AI technology. This focus on innovation not only enhances its existing solutions but also paves the way for new product offerings.

Profitability and Financial Health

The company’s journey towards profitability and its overall financial health are critical aspects of its financial highlights. By maintaining a balance between growth and profitability, BigBear AI is positioning itself for long-term success in the competitive AI market.

Future Outlook for BigBear AI

The future outlook for BigBear AI is promising, with the company poised to capitalize on the expanding AI market. Its focus on decision intelligence solutions, coupled with strategic partnerships and a commitment to innovation, positions BigBear AI for sustained growth. As AI continues to permeate various sectors, BigBear AI’s expertise in delivering tailored solutions for complex challenges will likely drive its expansion and enhance its market share. The company’s ability to adapt to market trends and invest in emerging technologies will be crucial in maintaining its competitive edge and meeting the evolving needs of its clientele.

See more:7 Best AI Stocks to Watch in Q1 2024

Investor Sentiment and Market Reactions

Investor sentiment towards BigBear AI is a complex interplay of optimism and caution, reflecting the broader dynamics of the AI market and the company’s performance.

Bullish Optimism Amidst AI Boom

The bullish sentiment surrounding BigBear AI is fueled by the AI sector’s overall growth and the company’s strategic initiatives. Investors are optimistic about BigBear AI’s potential to leverage the AI boom, particularly in decision intelligence, to secure a dominant market position.

Caution and Risk Assessment

Despite the optimism, there is a degree of caution among investors, driven by the inherent risks associated with the rapidly evolving AI sector. Market volatility and the speculative nature of AI investments necessitate a careful assessment of BigBear AI’s long-term viability and growth prospects.

Market Response to Financial Performance

The market’s response to BigBear AI’s financial performance and strategic moves is a critical indicator of investor sentiment. Positive financial results and strategic achievements can bolster investor confidence, while any setbacks may prompt a reevaluation of the company’s market position and future potential.

Conclusion

BigBear AI’s recent stock surge is a reflection of the company’s strong market position, innovative AI solutions, and the overall positive sentiment in the AI sector. As BigBear AI continues to navigate the complexities of the AI landscape, its focus on delivering high-quality, AI-driven decision intelligence solutions is expected to keep it at the forefront of investors’ minds and market trends.