AI Stocks on the Rise: A 2024 Outlook

The dawn of artificial intelligence (AI) has not only revolutionized technology and everyday life but has also opened up a new frontier for investors. With AI technologies becoming increasingly integral to a wide range of industries, from healthcare and finance to automotive and entertainment, AI stocks represent a dynamic and potentially lucrative segment of the market. This article delves into the world of AI investments, highlighting key players poised for significant growth and offering insights into the strategies for navigating this exciting investment landscape.

With the rapid development of artificial intelligence (AI) technology, AI stocks have become a hot spot for investors. This article provides a comprehensive outlook on AI stock investment in 2024, from AI stocks that are about to soar to investment strategies, revealing the potential and challenges of the AI field for investors.

Table of Contents

Introduction to AI Stocks

AI stocks encompass a broad spectrum of companies, from tech giants pioneering AI research and development to innovative startups revolutionizing specific market segments with AI-driven solutions. Investing in AI stocks offers the dual promise of supporting the advancement of groundbreaking technologies while potentially reaping substantial financial rewards. As AI continues to push the boundaries of what’s possible, understanding the landscape of AI stocks becomes crucial for investors aiming to capitalize on the AI revolution.

5 AI Stocks That Will Skyrocket

While the exact market caps and prices were not specified, the insider trading activity and institutional interest in these companies hint at their potential for significant growth. Below is a speculative table based on their known performance and industry standing:

Also read:7 Best AI Stocks to Watch in Q1 2024

Name | Stock Symbol | Market Cap | Price |

|---|---|---|---|

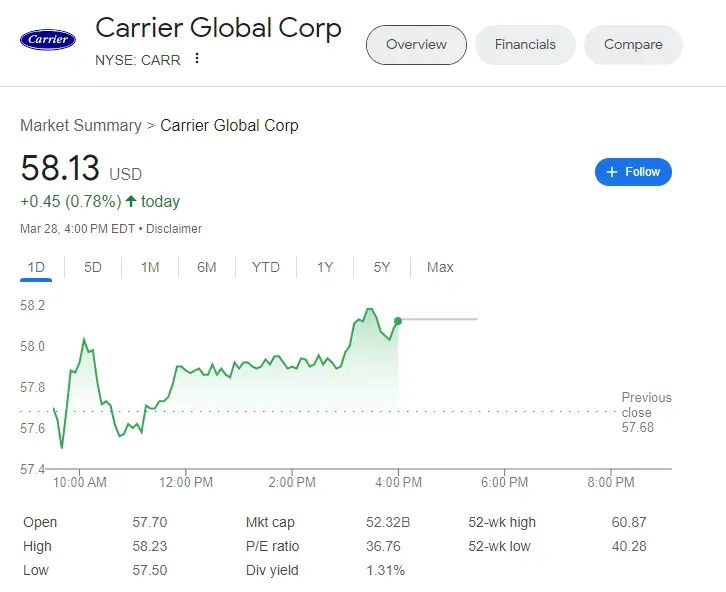

Carrier Global Corp | CARR | $52.32B | $58.13 |

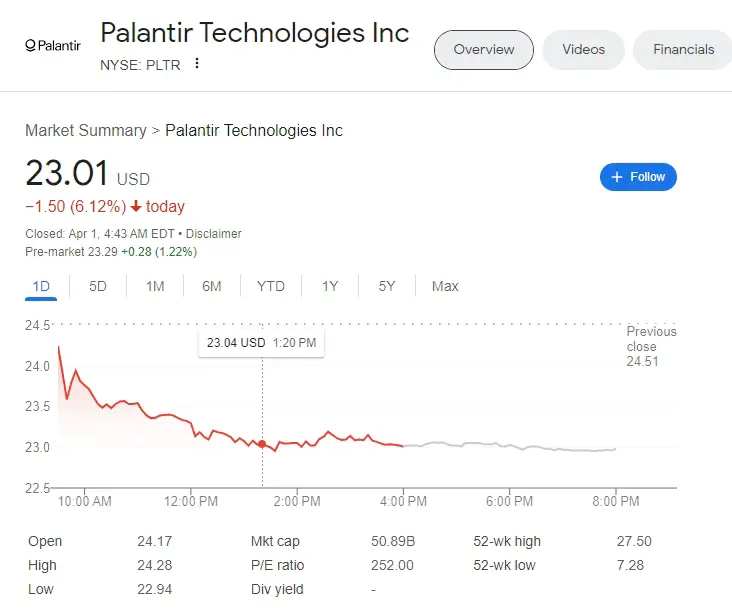

Palantir Technologies Inc. | PLTR | $50.89B | $23.01 |

Ulta Beauty Inc | ULTA | $25.24B | $522.88 |

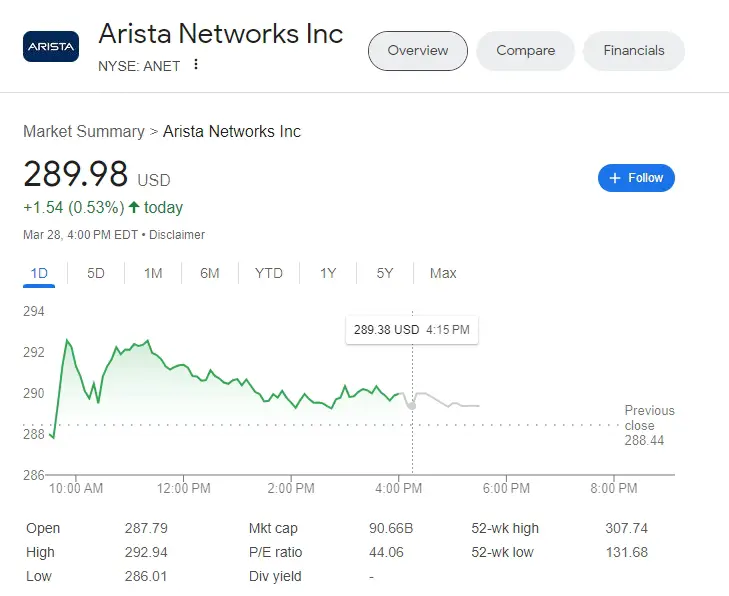

Arista Networks Inc | ANET | $90.66B | $289.98 |

Vertiv Holdings Co | VRT | $31.2B | $81.67 |

Carrier Global Corp (CARR)

Carrier Global Corp has solidified its stance in the climate and industrial sector with a significant push towards innovation and sustainability. The company’s recent trend towards embracing eco-friendly solutions and smart technology integration in its products is a response to the growing demand for sustainable living and working environments. With governments and corporations worldwide intensifying their focus on green initiatives, Carrier’s commitment to developing energy-efficient systems positions it advantageously in the market. The stock’s potential surge can be attributed to its strategic acquisitions aimed at expanding its product portfolio and geographic reach, thus enhancing its competitive edge. Carrier’s robust financial performance, driven by a strong global presence and a diversified customer base, makes it an attractive investment. The company’s forward-looking approach in harnessing IoT and cloud-based technologies for predictive maintenance and energy management further underscores its growth potential in the evolving smart infrastructure landscape.

Palantir Technologies Inc. (PLTR)

Palantir Technologies Inc., renowned for its sophisticated data analytics platforms, has been at the forefront of transforming how organizations harness big data for operational intelligence and decision-making. The company’s recent trend involves deepening its engagement with government and defense contracts, alongside expanding its footprint in the commercial sector. Palantir’s potential for a significant upturn is underpinned by its strategic partnerships and the increasing relevance of big data analytics across industries—from healthcare to automotive. As digital transformation accelerates, Palantir’s ability to offer tailored, scalable solutions for complex data environments positions it as a pivotal player in the AI and analytics space. The investment appeal lies in Palantir’s sustained revenue growth, driven by long-term contracts and its expanding suite of software applications that promise to unlock new market segments. The company’s commitment to continuously enhancing its platforms through AI and machine learning innovations further solidifies its growth trajectory.

Ulta Beauty Inc. (ULTA)

Ulta Beauty Inc. has consistently outperformed in the retail sector, capitalizing on the burgeoning beauty and personal care market. The company’s recent trend includes an aggressive expansion of its physical and online presence, coupled with strategic partnerships that enhance its product offerings. Ulta’s potential surge is bolstered by the resilient demand for beauty products and services, alongside its unique position as a one-stop beauty destination offering a wide range of products across various price points. The company’s investment in digital transformation, including augmented reality (AR) try-on features and personalized shopping experiences, caters to the evolving consumer preferences, driving increased engagement and customer loyalty. Ulta’s robust financial health, evidenced by strong sales growth and operational efficiency, alongside its dynamic omni-channel strategy, presents a compelling investment case. The company’s focus on diversity and inclusion in its product lines and marketing initiatives further enhances its brand appeal and market position.

Arista Networks Inc. (ANET)

Arista Networks Inc. is a standout in the networking technology sector, specializing in scalable cloud networking solutions. The company’s trend towards innovating high-performance and ultra-low latency networks for data center and cloud environments aligns with the exponential growth in data traffic and cloud computing demand. Arista’s potential for a significant uptick is driven by its leading-edge technology that addresses the critical needs of Internet companies, cloud service providers, and large enterprises. The investment rationale for Arista is grounded in its strong financial performance, marked by consistent revenue growth and high margins, reflective of its technological leadership and operational excellence. Arista’s commitment to R&D, focusing on software-driven networking solutions, positions it to capitalize on future digital infrastructure developments. Its strategic collaborations and focus on expanding its product portfolio to include AI-driven networking features further underscore its growth prospects in the rapidly evolving tech landscape.

Vertiv Holdings Co (VRT)

Vertiv Holdings Co plays a crucial role in the digital infrastructure sector, offering critical power, cooling, and IT infrastructure solutions. The company’s trend towards supporting the burgeoning demand for data centers and edge computing is a response to the global digitalization push. Vertiv’s growth potential is anchored in the escalating need for reliable and efficient digital infrastructure to support the expansion of 5G, IoT, and cloud services. The company’s strategic acquisitions and innovations in energy-efficient cooling technologies and uninterruptible power supplies (UPS) cater to the sustainability and performance requirements of modern data centers. The stock’s investment appeal lies in Vertiv’s robust order book, driven by strong demand in key markets, and its focus on operational excellence. The company’s strategic initiatives to expand its services and solutions portfolio, alongside its emphasis on sustainability, position Vertiv as a key beneficiary of the digital economy’s growth.

Investing in AI: Blue-chip vs. Startups

The AI investment landscape is marked by the contrast between blue-chip tech giants with significant AI initiatives and agile startups at the cutting edge of AI innovation. Each offers unique opportunities and challenges for investors.

The Stalwarts of Technology

Established tech companies provide a relatively stable investment in the burgeoning AI market, backed by substantial R&D budgets and diverse product lines. Their involvement in AI, from cloud computing services to consumer electronics integrated with AI functionalities, showcases the broad applicability and potential profitability of AI technologies.

The Pioneers of Tomorrow

Startups focused on AI represent high-risk, high-reward investment opportunities. These companies, often at the forefront of AI application in niche markets, offer investors the chance to be part of potentially groundbreaking advancements. However, their success hinges on various factors, including technology viability, market adoption, and the ability to scale.

How to Invest in AI Stocks?

For those looking to dive into AI investments, here’s a straightforward guide to getting started:

Open a Brokerage Account: Choose a reputable broker with access to a wide range of stocks and ETFs to start your investment journey.

Research and Select Your Investments: Decide between individual AI stocks or diversified AI ETFs based on your risk tolerance and investment goals.

Consider Diversification: Balance your portfolio between blue-chip companies and AI startups to mitigate risk while capturing growth.

Stay Informed: Keep up with the latest AI trends and market developments to make informed decisions and adjust your investments as needed.

ETFs and AI: Broad Exposure to Innovation

Exchange-Traded Funds (ETFs) specializing in AI offer investors a way to gain broad exposure to the AI sector without picking individual stocks. These ETFs track indices composed of companies leading in AI research, development, and application, providing a balanced investment in the AI ecosystem.

The Benefits of AI ETFs

AI ETFs simplify the investment process by offering a curated selection of companies across various aspects of AI, from hardware and software to services and applications. This diversification helps mitigate the risks associated with investing in a rapidly evolving tech sector.

Selecting the Right AI ETF

When choosing an AI ETF, consider factors such as the fund’s performance history, expense ratio, and the specific companies it includes. Look for ETFs that align with your investment philosophy and the sectors of AI you believe have the most growth potential.

The AI Bubble: Speculation vs. Reality

The explosive growth of AI has ignited a debate around the potential for an AI bubble, where speculation outpaces the real-world applicability and financial viability of AI technologies. This discourse is crucial for investors and stakeholders in discerning hype from sustainable innovation. While enthusiasm for AI’s transformative potential is warranted, it is essential to approach AI investments with a nuanced understanding of the industry’s dynamics.

Understanding the Hype Cycle

The hype cycle for emerging technologies often leads to inflated expectations, particularly in sectors as promising as AI. While groundbreaking advancements in machine learning, natural language processing, and robotics capture the public’s imagination, they also breed speculative investments. The disparity between the perceived potential and the current capabilities of AI technologies can create bubbles. Investors must differentiate between companies with solid AI applications and those leveraging AI as a buzzword for valuation boosts.

Evaluating the Substance Behind AI Claims

Scrutiny of AI companies’ claims about their technology’s capabilities and market potential is vital. Many startups and established firms tout AI as a core component of their offerings, yet only a subset possess the technological prowess and data infrastructure to deliver on these promises. Investors should seek evidence of patented technologies, peer-reviewed research, and demonstrable applications that offer competitive advantages. The sustainability of an AI enterprise often hinges on its intellectual property and the defensibility of its technology.

Market Adoption and Revenue Generation

The ultimate test of an AI company’s viability is its ability to foster market adoption and generate revenue. Early excitement about technology must translate into tangible products and services that address genuine market needs. Companies leading the way in AI have successfully integrated AI solutions into sectors like healthcare, finance, and e-commerce, demonstrating not just technological innovation but also market fit and revenue growth. This real-world application and financial success are critical markers separating speculative ventures from substantive ones.

Navigating AI Investments: Strategies for Success

Investing in AI presents a unique set of challenges and opportunities, requiring strategies that balance the potential for high rewards with the risks of a rapidly evolving technology landscape. Successful navigation through the AI investment space demands a discerning approach, focused on long-term value rather than short-term hype.

Conducting Thorough Due Diligence

Due diligence is paramount in AI investing, where the technical complexity and market novelty of offerings necessitate a deeper understanding. Investors should engage with the underlying technology, team expertise, and business models of AI companies. Evaluating the company’s research output, technology stack, and use cases provides insights into its innovation level and market applicability. Such comprehensive analysis helps in distinguishing genuinely disruptive companies from those with superficial AI integrations.

Diversification Across AI Sectors

Diversification remains a key strategy in mitigating risks associated with AI investments. The AI landscape is vast, encompassing everything from autonomous vehicles and healthcare diagnostics to cybersecurity and personalized marketing. By spreading investments across different AI applications and sectors, investors can protect against sector-specific downturns while capitalizing on the broad growth of AI technologies.

Long-Term Horizon and Patience

AI development and market penetration are often slow and unpredictable, necessitating a long-term investment horizon. Breakthroughs in AI can take years of research and development, and market adoption can be gradual. Investors should be prepared for a long-term commitment, allowing AI companies the time to refine their technologies, scale their operations, and achieve sustainable profitability. Patience and a focus on long-term trends over short-term fluctuations are crucial for realizing the potential of AI investments.

Final Words

As we stand on the brink of a new era in technology and investment, AI stocks offer a unique opportunity to participate in the shaping of the future. From blue-chip companies to innovative startups, the AI sector is ripe with potential for discerning investors. By approaching AI investments with a balanced strategy, focusing on long-term trends over short-term hype, investors can navigate this dynamic market to achieve success. As AI continues to evolve, its impact on industries, economies, and society at large will undoubtedly present new challenges and opportunities for investors ready to embrace the future of technology.